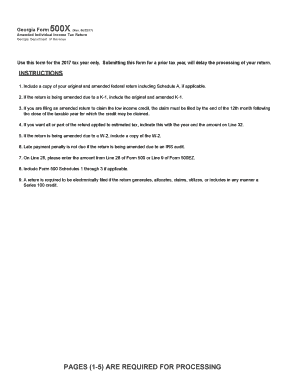

Get Ga Dor 500x 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA DoR 500X online

How to fill out and sign GA DoR 500X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Recording your earnings and submitting all necessary tax documents, including GA DoR 500X, is solely the duty of a US citizen.

US Legal Forms makes your tax preparation much clearer and more precise.

Safeguard your GA DoR 500X. Ensure that all your accurate documents and information are correctly organized while keeping in mind the deadlines and tax rules established by the IRS. Simplify the process with US Legal Forms!

- Obtain GA DoR 500X directly through your browser on your device.

- Access the fillable PDF with a single click.

- Begin completing the web-template step by step, using the guidance of the advanced PDF editor's interface.

- Carefully input text and figures.

- Click on the Date box to automatically insert the current date or adjust it manually.

- Utilize the Signature Wizard to create your unique e-signature and sign in moments.

- Review IRS guidelines if you have further questions.

- Select Done to preserve the modifications.

- Continue to print the document, store it, or send it via Email, text, Fax, or USPS without leaving your browser.

How to modify Get GA DoR 500X 2017: personalize forms online

Experience a hassle-free and paperless approach to working with Get GA DoR 500X 2017. Utilize our reliable online solution and conserve substantial time.

Creating every form, including Get GA DoR 500X 2017, from the beginning takes too much time, so leveraging a tried-and-true platform of pre-uploaded document templates can work wonders for your efficiency.

However, dealing with them can pose challenges, particularly with PDF format files. Fortunately, our extensive library features a built-in editor that enables you to swiftly complete and modify Get GA DoR 500X 2017 without departing our site, thus preventing you from squandering hours filling out your forms. Here’s what you can accomplish with your document utilizing our tools:

Whether you need to finalize editable Get GA DoR 500X 2017 or any other document in our catalog, you’re on the correct path with our online document editor. It's straightforward and secure, requiring no specific skills.

Our web-based tool is tailored to manage practically everything you can envision regarding file editing and completion. Say goodbye to the traditional method of managing your forms. Opt for a more effective alternative that assists in streamlining your tasks and making them less reliant on paper.

- Step 1. Find the required document on our website.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize specialized editing functions that allow you to insert, eliminate, annotate, and emphasize or obscure text.

- Step 4. Create and append a legally-binding signature to your document by using the sign option from the upper toolbar.

- Step 5. If the document layout doesn’t appear as you wish, take advantage of the options on the right to eliminate, position, and rearrange pages.

- Step 6. Include fillable fields so others can be invited to complete the document (if necessary).

- Step 7. Distribute or send the form, print it out, or choose the format in which you’d prefer to receive the document.

Get form

Related links form

A Georgia composite return allows pass-through entities, like partnerships or S-corporations, to file on behalf of their non-resident members. This simplifies the tax filing process for those entities and ensures that the non-residents fulfill their state tax obligations. Utilizing GA DoR 500X can further clarify the requirements for filing these types of returns.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.