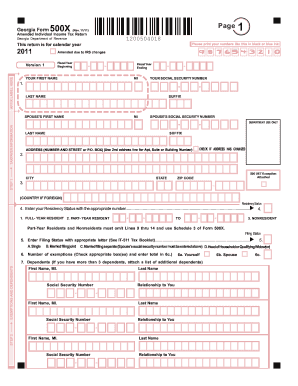

Get Ga Dor 500x 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA DoR 500X online

How to fill out and sign GA DoR 500X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all the essential tax documents, including GA DoR 500X, is solely the obligation of a US citizen. US Legal Forms facilitates your tax management to be more accessible and accurate. You can locate any legal templates you need and fill them out digitally.

How to complete GA DoR 500X online:

Keep your GA DoR 500X safe. Ensure that all your pertinent papers and records are organized while being mindful of the deadlines and tax laws established by the IRS. Simplify the process with US Legal Forms!

- Access GA DoR 500X in your internet browser from any device.

- Enter the fillable PDF document with a click.

- Start filling out the form box by box, following the instructions of the advanced PDF editor's interface.

- Carefully input text and figures.

- Click the Date field to automatically set the current date or modify it manually.

- Utilize Signature Wizard to create your personalized e-signature and validate in moments.

- Refer to the Internal Revenue Service guidelines if you still have questions.

- Select Done to save your modifications.

- Proceed to print the document, download it, or send it via email, text, fax, or USPS without leaving your browser.

How to Modify Get GA DoR 500X 2011: Personalize Forms Online

Utilize our robust online document editor while preparing your forms. Complete the Get GA DoR 500X 2011, focus on the key details, and smoothly implement any necessary adjustments to its content.

Filling out paperwork digitally is not only efficient but also provides an opportunity to alter the template to fit your preferences. If you’re set to work on Get GA DoR 500X 2011, think about finalizing it with our extensive online editing features. Whether you make an error or input the required information in the wrong section, you can swiftly adjust the document without needing to start over as you would with manual completion. Additionally, you can emphasize significant information in your documentation by highlighting specific sections with colors, underlining them, or encircling them.

Follow these quick and straightforward steps to complete and modify your Get GA DoR 500X 2011 online:

Our comprehensive online solutions provide the optimal method to finalize and tailor the Get GA DoR 500X 2011 to your specifications. Use it to create personal or professional documents from any location. Access it in a browser, make alterations to your files, and return to them at any time in the future - all will be securely stored in the cloud.

- Open the document in the editor.

- Input the necessary information in the blank fields using Text, Check, and Cross tools.

- Navigate through the form to ensure you don't overlook any important sections.

- Circle some of the essential details and add a URL to it if required.

- Utilize the Highlight or Line features to underline the most crucial facts.

- Select colors and thickness for these lines to enhance the professional appearance of your document.

- Erase or blackout information that you wish to keep private.

- Substitute sections of content that include errors and enter the information you need.

- Conclude modifications with the Done button once you confirm everything is accurate in the form.

Get form

Related links form

Form 500X is the Georgia Amended Individual Income Tax Return used to make changes to a previously filed return. This form allows you to correct errors, update your filing status, or claim additional deductions or credits. Filing the GA DoR 500X can be straightforward, especially if you use platforms like uslegalforms, which provide guidance throughout the process. Amending your return can lead to better tax outcomes.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.