Loading

Get Ca Dof Std.204 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DoF STD.204 online

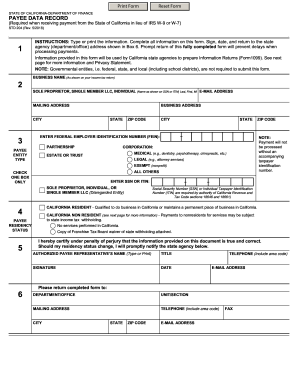

The Payee Data Record, CA DoF STD.204, is a crucial document for individuals and entities receiving payments from the State of California. Completing this form accurately helps ensure prompt processing of payments and compliance with tax regulations.

Follow the steps to fill out the CA DoF STD.204 online.

- Press the ‘Get Form’ button to access the online version of the CA DoF STD.204. Make sure to have the required information handy to fill it out accurately.

- Begin by entering the business name as it appears on your income tax return. If you are operating as a sole proprietor or a single member LLC, include your full name as shown on your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Provide your email address and the mailing address where you would like to receive correspondence. Be sure the mailing address is current and correct.

- Enter the physical business address if it differs from the mailing address. Include the city, state, and ZIP code of this location.

- Select the appropriate box that indicates your payee entity type. Options include sole proprietorship, corporation, partnership, etc. Only check one box.

- Input your Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN) in the specified fields. Ensure that this number is accurate, as payments will not be processed without it.

- Indicate your residency status by checking the appropriate box for either California resident or nonresident. Understand the definitions to select correctly based on your circumstances.

- Complete the certification by typing or printing the name of the authorized payee representative. Include their title, signature, date, telephone number, and email address.

- Review the entire form for any errors or omissions. Once verified, follow prompts to save your progress or finalize the submission. You may be able to download, print, or share the document as needed.

Make sure to complete and submit your documents online for efficient processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The payee data record for CA DoF STD.204 is the central piece of information that provides the necessary details about payees receiving payments from the state. This record ensures accurate tax reporting and helps avoid potential issues with the IRS. Maintaining correct payee data is crucial for timely payments and avoiding compliance penalties. US Legal Forms can assist you in accurately completing this record.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.