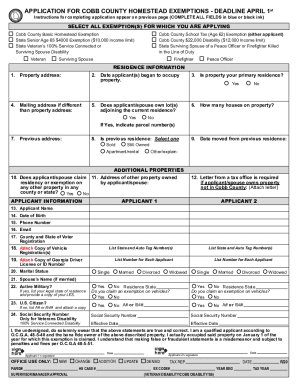

Get Ga Application For Cobb County Homestead Exemptions 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA Application for Cobb County Homestead Exemptions online

How to fill out and sign GA Application for Cobb County Homestead Exemptions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your earnings and submitting all necessary tax documentation, including GA Application for Cobb County Homestead Exemptions, is the exclusive duty of a US citizen. US Legal Forms facilitates your tax organization significantly to be more accessible and precise. You can obtain any legal documents you require and fill them out digitally.

How you can complete GA Application for Cobb County Homestead Exemptions online:

Safeguard your GA Application for Cobb County Homestead Exemptions diligently. Ensure that all your relevant documentation and information are appropriately organized while considering the deadlines and tax rules established by the IRS. Make it easy with US Legal Forms!

- Obtain GA Application for Cobb County Homestead Exemptions through your web browser from any device.

- Access the fillable PDF file with a single click.

- Begin filling in the template systematically, following the instructions of the advanced PDF editor's interface.

- Precisely enter textual information and figures.

- Select the Date field to automatically set the current day or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and validate in moments.

- Refer to the Internal Revenue Service guidelines if you still have any inquiries.

- Click Done to save the changes.

- Continue to print the document, save, or send it via email, text message, fax, USPS without exiting your browser.

How to amend Get GA Application for Cobb County Homestead Exemptions 2020: personalize forms online

Streamline your documentation process. Uncover the easiest method to locate, modify, and submit a Get GA Application for Cobb County Homestead Exemptions 2020.

The procedure for preparing Get GA Application for Cobb County Homestead Exemptions 2020 demands accuracy and attention, particularly from individuals who are not well versed in this kind of work. It is crucial to obtain an appropriate template and populate it with the right data. With the right tools for handling paperwork, you can access all the resources you need.

It’s straightforward to simplify your editing workflow without acquiring new abilities. Locate the correct example of Get GA Application for Cobb County Homestead Exemptions 2020 and complete it immediately without navigating between different browser tabs. Explore additional tools to modify your Get GA Application for Cobb County Homestead Exemptions 2020 form in the editing mode.

While on the Get GA Application for Cobb County Homestead Exemptions 2020 page, simply click the Get form button to begin adjusting it. Enter your information into the form in real-time, as all essential tools are readily available here. The template is pre-structured, so the minimal effort is required from the user. Just utilize the interactive fillable fields in the editor to effortlessly finish your paperwork. Click on the form and transition to the editor mode right away. Complete the interactive field, and your document is ready.

If you must add remarks to specific sections of the document, click on the Sticky tool and position a note where desired. Occasionally, a minor mistake can jeopardize the entire form if filled out manually. Eliminate errors in your documentation. Find the templates you require swiftly and complete them electronically using an intelligent editing solution.

- Add additional text around the document as necessary.

- Utilize the Text and Text Box tools to place text in a distinct box.

- Incorporate pre-designed graphic elements such as Circle, Cross, and Check using the respective tools.

- If necessary, capture or upload pictures to the document using the Image option.

- If you need to illustrate something in the document, employ Line, Arrow, and Draw tools.

- Try the Highlight, Erase, and Blackout features to modify the text in the document.

Related links form

The savings from the Georgia homestead exemption can vary widely based on the property's value and your specific exemption status. Generally, homeowners might save hundreds to thousands of dollars each year. These savings can have a considerable impact on your financial planning. To maximize your benefits, ensure you complete the GA Application for Cobb County Homestead Exemptions accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.