Get Ga Dor St-5 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA DoR ST-5 online

How to fill out and sign GA DoR ST-5 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

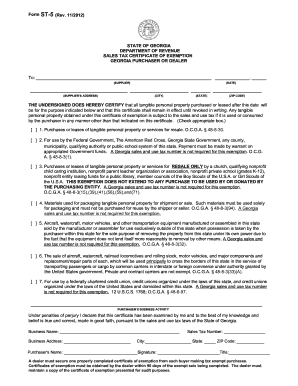

Submitting your earnings and reporting all necessary tax documents, such as GA DoR ST-5, is the exclusive responsibility of a US citizen.

US Legal Forms makes your tax management simpler and more precise. You will find any legal forms you need and complete them digitally.

Safeguard your GA DoR ST-5 appropriately. You should ensure that all your relevant documents and information are orderly, while being mindful of the deadlines and tax regulations set by the IRS. Make it simple with US Legal Forms!

- Obtain GA DoR ST-5 in your web browser from any device.

- Open the fillable PDF file with a click.

- Begin filling out the template field by field, following the instructions of the innovative PDF editor’s layout.

- Accurately input text and numbers.

- Click on the Date box to automatically set today’s date or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and authenticate in minutes.

- Refer to IRS guidelines if you have further questions.

- Click on Done to save your changes.

- Proceed to print the document, download, or share it via email, text, fax, or USPS without leaving your browser.

How to modify Get GA DoR ST-5 2012: tailor forms online

Utilize our extensive editor to convert a basic online template into a finalized document. Keep reading to understand how to alter Get GA DoR ST-5 2012 online effortlessly.

Once you find an ideal Get GA DoR ST-5 2012, all you need to do is modify the template to suit your requirements or legal stipulations. Besides filling in the editable form with correct information, you may need to remove some clauses in the document that do not pertain to your situation. Conversely, you may wish to include additional conditions in the original template. Our sophisticated document editing tools are the easiest way to amend and modify the form.

The editor allows you to modify the content of any form, even if the document is in PDF format. You can add and delete text, insert fillable fields, and implement further modifications while retaining the original formatting of the document. Additionally, you can restructure the document by altering the page sequence.

You don’t need to print the Get GA DoR ST-5 2012 to affix your signature. The editor features electronic signature functionality. Most of the forms already include signature fields. Thus, you simply need to place your signature and request one from the additional signing party via email.

Follow this step-by-step guide to create your Get GA DoR ST-5 2012:

After all parties sign the document, you will receive a signed copy which you can download, print, and distribute to others.

Our solutions allow you to save significant time and reduce the risk of errors in your documents. Improve your document workflows with effective editing tools and a robust eSignature solution.

- Open the desired template.

- Utilize the toolbar to customize the form to your likings.

- Fill in the form with accurate information.

- Click on the signature field and apply your electronic signature.

- Send the document for signature to other signers if necessary.

Get form

A certificate of exemption for sales tax in California serves a similar function to the GA DoR ST-5 in Georgia. It allows buyers in California to document their eligibility for sales tax exemptions, facilitating tax-exempt transactions. While the processes may differ by state, understanding the requirements for such certificates is vital for compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.