Loading

Get Ga Dor St-3use 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR ST-3USE online

This guide provides clear instructions for users on how to fill out the Georgia Department of Revenue's ST-3USE form online. It is designed to support individuals who may have little legal experience but need to comply with the consumer's use tax requirements.

Follow the steps to complete the GA DoR ST-3USE form online.

- Press the ‘Get Form’ button to access the GA DoR ST-3USE form online for filling out or completion.

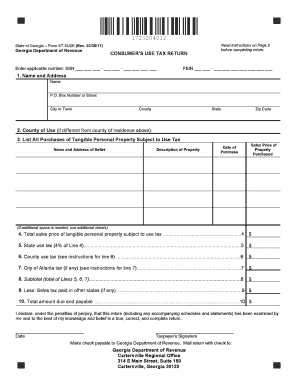

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated field at the top of the form.

- In section 1, provide your name and complete address, including your county of residence for proper identification.

- If the county where the purchased property was used is different from your county of residence, specify it in section 2.

- For section 3, list all tangible personal property purchases that are subject to use tax. Include the name and address of the seller, a description of the property, the purchase date, and the sales price.

- Calculate the total sales price of all purchases listed in section 3 and enter this amount on line 4.

- For line 5, multiply the amount in line 4 by the 4% state use tax rate and record this in the appropriate field.

- To determine the county use tax for line 6, multiply the amount in line 4 by the applicable county tax rate and enter the result.

- If applicable, calculate the city of Atlanta tax and enter it on line 7 by multiplying line 4 by the rate for the city.

- Add together the amounts from lines 5, 6, and 7, and record the total on line 8.

- If applicable, enter any sales tax paid in other states on line 9.

- Finally, subtract the amount on line 9 from the total on line 8 and enter this amount on line 10, representing the total amount due.

- Before submitting, make sure to sign, print your name, and include the date of submission at the bottom of the form.

Complete your GA DoR ST-3USE form online to ensure compliance with Georgia consumer's use tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Obtaining a GA sales tax ID number involves registering with the Georgia Department of Revenue. You can apply online through their official website, providing necessary information about your business. If you need assistance during this process, the GA DoR ST-3USE offers guidance to help you navigate registration smoothly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.