Loading

Get Al Bpt-in 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL BPT-IN online

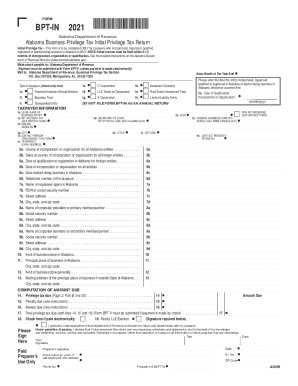

The AL BPT-IN is the Alabama Business Privilege Tax Initial Privilege Tax Return, designed for taxpayers who began their business operations in Alabama in 2021. This guide provides clear and detailed instructions for completing the form online, simplifying the process for users with various levels of experience.

Follow the steps to successfully complete the AL BPT-IN online.

- Click ‘Get Form’ button to access the AL BPT-IN online and open it for editing. This will allow you to fill out the necessary details conveniently.

- Begin by specifying the type of taxpayer by checking only one box in Section 1. Choose from options such as C Corporation, S Corporation, Business Trust, etc., depending on your business entity.

- In Section 3, enter the legal name of your business entity, the BPT account number, and the mailing address. This information is crucial for identification and correspondence.

- Provide essential details such as the date of incorporation, the state's county of incorporation, and the taxpayer's telephone number in Section 4. Select a contact person responsible for inquiries about this form.

- Fill out the information regarding principal business activities in Alabama, along with the business address in Section 6. This establishes your operational presence within the state.

- Proceed to Part A for the net worth computation. Complete the applicable section based on your entity's type (corporation, limited liability entity, or disregarded entity) detailing issued capital stock, retained earnings, and related debts.

- Move to Part B where you will list any exclusions and deductions applicable to your business. This includes investments in qualifying projects and other financial aspects based on the form’s guidance.

- Calculate the total privilege tax due, as outlined on the form, by summarizing the applicable net worth and calculating any necessary penalties or interest.

- Once all sections are completed and reviewed, finalize the submission by providing your signature and the date. Make sure to authorize a representative if applicable.

- Finally, save your changes, download the completed form, and print a copy for your records. You can also share it with the appropriate entities as required.

Start filling out the AL BPT-IN online today to ensure compliance with Alabama's business privilege tax regulations.

Related links form

Allow at least six weeks after filing your return, then check the status of your refund on our website at www.myalabamataxes.alabama.gov, or call our 24-hour toll-free refund hotline at 1-855-894-7391 or daytime refund status line at 334-309-2612.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.