Loading

Get Ne Form 22 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 22 online

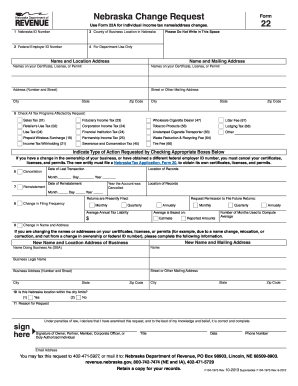

Filling out the NE Form 22 online is a straightforward process that allows users to request changes to their Nebraska tax certificates, licenses, or permits. This guide provides detailed, step-by-step instructions to ensure a smooth experience for all users.

Follow the steps to complete the NE Form 22 online.

- Click ‘Get Form’ button to access and open the form in your preferred document editor.

- Enter your Nebraska ID number in the designated field, ensuring it is accurate and matches your records.

- Input your Federal Employer ID Number in the corresponding field. If you do not have one, enter 'Applied For' or your Social Security number.

- Specify the county where your business is located by selecting it from the available options.

- Provide your current name and mailing address as filed with the Nebraska Department of Revenue. Then enter the new name and mailing address if applicable.

- Check all tax programs that are affected by your request. Ensure you mark all programs relevant to your situation.

- Indicate the type of action requested by checking the appropriate boxes indicating cancellation, reinstatement, or change in filing frequency, along with relevant dates.

- Complete the section on your new name and mailing address if applicable, ensuring that the location address is a physical street address.

- Provide a detailed reason for your request in the space provided. Include any necessary context or changes in ownership.

- Sign the form in the designated area and include your title, date, phone number, and email address.

- After reviewing all sections for accuracy, save your changes. You can then download, print, or share the completed form as needed.

Complete your NE Form 22 online today and ensure your tax information is up to date.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing sales tax on your taxes involves reporting sales tax collected on your tax return. Use the appropriate forms provided by the Nebraska Department of Revenue and ensure that the figures align with your sales records. The NE Form 22 can provide necessary tax structure guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.