Loading

Get Tx Comptroller 05-163 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-163 online

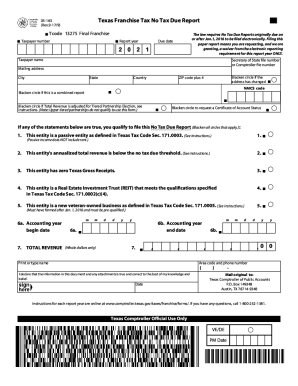

Filling out the TX Comptroller 05-163 form can be straightforward with the right guidance. This guide provides clear, step-by-step instructions to ensure that you complete the form accurately and efficiently. Follow these steps to submit your form online confidently.

Follow the steps to fill out the TX Comptroller 05-163 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying information in the designated fields at the top section of the form. This typically includes your name, address, and contact information.

- Proceed to the section that requires details regarding your financial information. Be sure to provide accurate figures as they pertain to your specific circumstances.

- Review any additional questions or sections carefully, ensuring you provide complete and accurate answers.

- Once all sections are completed, double-check your inputs for accuracy and completeness.

- You can then save changes, download, print, or share the form as needed.

Complete your TX Comptroller 05-163 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In the state of Texas, franchise tax is considered to be a "privilege" tax, which is a tax that is imposed on companies chartered in Texas or doing business in Texas. ... It is typically based on a company's net worth, rather than on annual taxable income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.