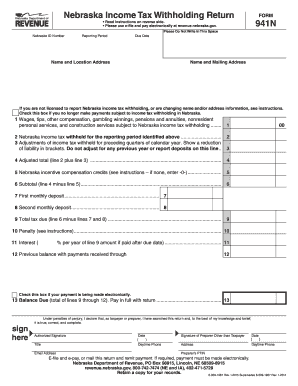

Get NE DoR 941N 2014

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Undercollection online

How to fill out and sign Incometax online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

These days, most Americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. The US Legal Forms web-based service makes the process of e-filing the NE DoR 941N simple and convenient. Now it takes at most thirty minutes, and you can accomplish it from any place.

The best way to get NE DoR 941N easy and fast:

-

Access the PDF blank in the editor.

-

Refer to the highlighted fillable lines. This is where to place your details.

-

Click the option to pick if you find the checkboxes.

-

Go to the Text tool and also other sophisticated functions to manually customize the NE DoR 941N.

-

Inspect all the details before you resume signing.

-

Create your unique eSignature using a key-board, camera, touchpad, computer mouse or mobile phone.

-

Certify your template online and specify the particular date.

-

Click Done proceed.

-

Download or send out the document to the recipient.

Be sure that you have filled in and delivered the NE DoR 941N correctly in due time. Look at any applicable term. If you provide wrong data in your fiscal papers, it can result in severe fees and create problems with your annual tax return. Use only professional templates with US Legal Forms!

How to edit Nonresidents: customize forms online

Use our advanced editor to transform a simple online template into a completed document. Keep reading to learn how to modify Nonresidents online easily.

Once you discover an ideal Nonresidents, all you need to do is adjust the template to your needs or legal requirements. Apart from completing the fillable form with accurate information, you might need to delete some provisions in the document that are irrelevant to your case. Alternatively, you might want to add some missing conditions in the original template. Our advanced document editing tools are the best way to fix and adjust the form.

The editor allows you to modify the content of any form, even if the document is in PDF format. You can add and erase text, insert fillable fields, and make extra changes while keeping the original formatting of the document. Also you can rearrange the structure of the form by changing page order.

You don’t need to print the Nonresidents to sign it. The editor comes along with electronic signature functionality. Most of the forms already have signature fields. So, you just need to add your signature and request one from the other signing party via email.

Follow this step-by-step guide to make your Nonresidents:

- Open the preferred template.

- Use the toolbar to adjust the template to your preferences.

- Fill out the form providing accurate details.

- Click on the signature field and add your electronic signature.

- Send the document for signature to other signers if necessary.

Once all parties complete the document, you will get a signed copy which you can download, print, and share with other people.

Our solutions enable you to save tons of your time and reduce the chance of an error in your documents. Enhance your document workflows with effective editing capabilities and a powerful eSignature solution.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing isreceived

Simplify the entire Form22 preparation process with this easy-to-understand video backed up by superior experience. Discover how to spend less time on better template completion on the web.

Nonresident FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to NE DoR 941N

- W-3N

- 501n

- e-pay

- W3N

- isreceived

- Form22

- nonresident

- Payor

- undercollection

- preparers

- Ruling9914-2

- incometax

- Nonresidents

- 1Wages

- ptin

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.