Loading

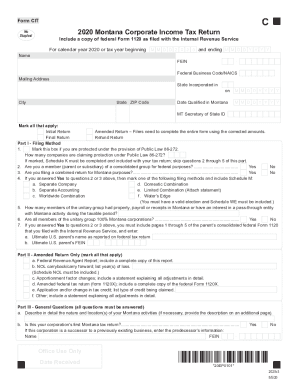

Get Mt Cit (clt-4) 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT CIT (CLT-4) online

This guide provides clear and comprehensive instructions on filling out the MT CIT (CLT-4) form online. Whether you are a business owner or a representative filing on behalf of a corporation, this step-by-step approach ensures you have the necessary information at your fingertips.

Follow the steps to successfully complete your MT CIT (CLT-4) online.

- Click the ‘Get Form’ button to obtain the form and access it in the online editor.

- Fill in Part I, indicating your filing method. Mark the appropriate boxes to specify if you are filing under Public Law 86-272 or if you are part of a consolidated group for federal purposes.

- In Part II, complete the amended return section if applicable. Mark which changes are pertinent to your filing, such as federal revenue reports or net operating loss adjustments.

- Move to Part III, where you will answer general questions. Provide a detailed description of your Montana activities and indicate if this is your corporation's first Montana tax return.

- Continue to provide member and ownership information. For related entities, include the percentages of ownership and any applicable affiliations.

- Fill out Part IV regarding special transactions. Indicate if you filed specific forms with the IRS and attach copies as needed.

- Proceed to calculate your Montana taxable income and net amount due in the computation section. Carefully follow each line to include additions and reductions as indicated.

- Complete the apportionment factor calculations in Schedule K if applicable, to report your Montana income accurately.

- Fill out Schedule C to claim tax credits. Include totals from all applicable lines and ensure that required forms are attached.

- Once all sections are accurately filled, review your information. Save the document, and then choose to download, print, or share your MT CIT (CLT-4) form online.

Complete your MT CIT (CLT-4) form online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.