Loading

Get Md Comptroller Mw506nrs 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW506NRS online

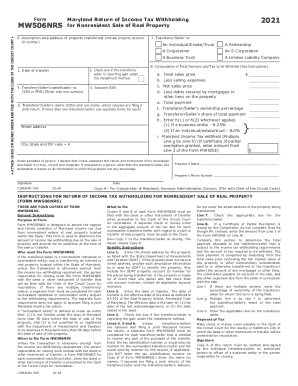

Filling out the MD Comptroller MW506NRS form is essential for nonresident sellers of real property in Maryland to ensure proper income tax withholding. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the MD Comptroller MW506NRS online:

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter the description and address of the property being transferred, including the property account ID number.

- Input the date of the transfer, which is defined as the effective date of the deed.

- Check the box if the transferor or seller is reporting gain under the installment method.

- Enter the identification number of the transferor/seller, which can be either a Social Security Number (SSN) or a Federal Employer Identification Number (FEIN). Ensure to enter only one number.

- If applicable, input the spouse’s SSN.

- Provide the name of the transferor/seller. If spouses are filing a joint return, you may enter both names. Otherwise, enter one name only.

- Complete the address fields, including the street address, city, state, and ZIP code.

- Indicate the type of transferor/seller by checking the appropriate box (e.g., Individual, Partnership, Corporation, etc.).

- Proceed to the computation of total payment and tax to be withheld. Complete the financial sections indicated in Lines a-h.

- Calculate the total sales price and subtract any selling expenses to determine the net sales price.

- Further deduct debts secured by mortgages or other liens on the property from the net sales price.

- Input your ownership percentage and compute your share of the total payment.

- Select the applicable withholding rate based on whether the transferor/seller is an individual or business entity.

- Finally, verify the information entered, sign where indicated, and save the changes. You can download, print, or share the completed form as needed.

Complete your document online today to ensure compliance with Maryland's income tax withholding requirements.

Related links form

For 2020, the rate of withholding for Maryland residents is 5.75% plus the local tax rate. For Maryland nonresidents the rate is increased to 8.0% (the resident rate of 5.75% plus the nonresident rate of 2.25%). For Maryland residents employed in Delaware the rate is 3.2%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.