Loading

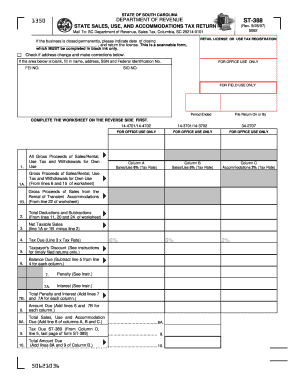

Get Sc St-388 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC ST-388 online

This guide provides a comprehensive overview of how to fill out the SC ST-388 form online. Whether you are a business owner or a designated representative, this step-by-step process will ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the SC ST-388 form online.

- Click the ‘Get Form’ button to acquire the SC ST-388 and open it in the editor.

- Begin by reviewing the form to ensure you have proper identification, including your retail license number or use tax registration details. If there have been any address changes, check the relevant box and make corrections in the provided fields.

- Complete the worksheet on the reverse side of the form before entering any figures on the front. Calculate your gross proceeds of sales, rentals, use tax, and withdrawals for your own use.

- Fill in the appropriate columns for different tax rates: 6%, 5%, and 2% for accommodations. Ensure that all totals for gross proceeds and deductions are entered correctly.

- Calculate the net taxable sales by subtracting the total deductions from your gross proceeds. This value will be critical for determining the tax due.

- Compute the tax due by multiplying the net taxable sales by the appropriate tax rate. Document any taxpayer discounts that apply based on your situation and the filing instructions.

- Total the amounts due, including any penalties and interest, to determine the final balance owed.

- Sign and date the form to certify its accuracy. Double-check all entries for completeness and correctness.

- Once completed, you can save your changes, download the form, or print it for submission. Ensure all documents are sent to the correct department to avoid any delays.

Complete your documents online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out an Employee Withholding Exemption Certificate, you need to give your personal information and indicate any exemptions you claim. Be precise in explaining the reason for your exemption status, and make sure to sign and date the certificate. Using SC ST-388 can help clarify any uncertainties during this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.