Loading

Get Vt Sut-451 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT SUT-451 online

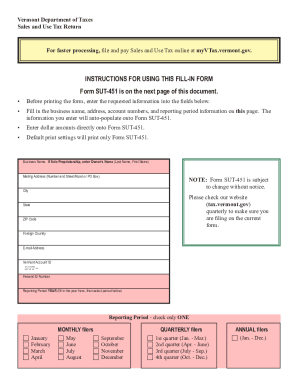

The VT SUT-451 is a crucial document for businesses to report sales and use tax in Vermont. This guide provides straightforward, step-by-step instructions on how to correctly complete the form online, ensuring accuracy and compliance.

Follow the steps to successfully fill out the VT SUT-451 online.

- Press the ‘Get Form’ button to access the VT SUT-451 online and open it for editing.

- Begin by entering your business name in the appropriate field. If you are a sole proprietorship, please enter the owner's name formatted as Last Name, First Name.

- Fill in your mailing address, including the number and street or road, and PO Box if applicable.

- Complete the city, state, and ZIP code. If your business is located outside of the United States, include the foreign country in the designated field.

- Provide your Vermont Account ID and Federal ID number in the respective fields.

- Specify the reporting period by entering the year, and select the relevant period (monthly, quarterly, or annual) by checking the appropriate box. Make sure only one option is selected.

- Input dollar amounts for total sales, nontaxable sales, and taxable sales in the corresponding fields. Ensure that you perform calculations accurately, particularly for taxable sales which is the total sales minus nontaxable sales.

- Calculate the total state sales tax due and enter this amount in the designated section. Use the recommended percentage for calculations.

- If applicable, enter local option taxes due for each municipality in Part II, following the same careful process.

- In the certification section, certify the accuracy of your return with your signature, title, date, and telephone number.

- Finally, review all entries for completeness and accuracy. Save your changes, and select the option to download, print, or share the form as needed.

Complete your documents online and ensure your compliance today.

Related links form

In the state of Vermont, any clothing accessories or equipment, protective equipment, and any recreational or sports equipment are considered to be taxable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.