Loading

Get Ny Dtf It-280 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-280 online

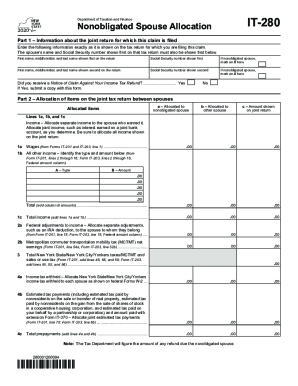

The NY DTF IT-280 form is used by nonobligated spouses to allocate items on a joint tax return. This guide provides step-by-step instructions on how to complete the form efficiently and accurately in an online format.

Follow the steps to fill out the NY DTF IT-280 online.

- Press the ‘Get Form’ button to access the NY DTF IT-280 form and open it in your online editing tool.

- Begin filling out Part 1 by entering the first name, middle initial, last name, and Social Security number of the spouse listed first on the tax return. Ensure the information matches exactly as it appears on the tax return.

- If you are the nonobligated spouse, mark an X in the designated box. Then enter the first name, middle initial, last name, and Social Security number of the second spouse.

- Indicate whether you received a notice of claim against your income tax refund by selecting Yes or No, and provide a copy of the notice if applicable.

- Proceed to Part 2 to allocate income and adjustments. For each category, fill out the allocated items for both spouses and the total amounts shown on the joint return, ensuring accuracy in separating each source of income and adjustments.

- Complete all necessary fields under Part 2, marking the allocated amounts to both spouses accurately according to your documentation.

- In Part 3, under penalties of perjury, ensure both the nonobligated spouse and the other spouse sign and date the form. If applicable, include the preparer's details if someone else prepared the form.

- Once all sections are filled, review the form for accuracy. You can then save changes, download, print, or share the completed NY DTF IT-280 form as needed.

Start filling out your NY DTF IT-280 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.