Loading

Get In Form Bt-1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form BT-1 online

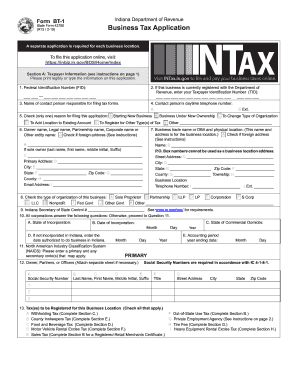

This guide provides comprehensive, step-by-step instructions for completing the Indiana Form BT-1 online. Whether you are starting a new business or updating your registration, this guide will assist you in navigating the form's requirements with ease.

Follow the steps to complete your business tax application efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Section A, Taxpayer Information, fill in your Federal Identification Number (FID). If you do not have one yet, indicate 'applied for' if you have submitted your application.

- Enter the name of your business, including legal name, partnership name, or corporate name. If applicable, check the box for a foreign address.

- Complete Section B for registering for sales tax and out-of-state use tax if applicable. Record your estimated monthly taxable sales and indicate if your business is seasonal.

- In Section I, provide the necessary signature and date, certifying that the information provided is accurate.

Start filling out your business tax application online today to ensure compliance and smooth operation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out an income tax return form, start with gathering all your financial documents, such as income statements and deductible expenses. Carefully follow the instructions for each section of the return, ensuring accuracy. If needed, the IN Form BT-1 may be part of this process if you're reporting business income, and uslegalforms can provide useful templates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.