Get Ny Dtf Ct-3-s 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

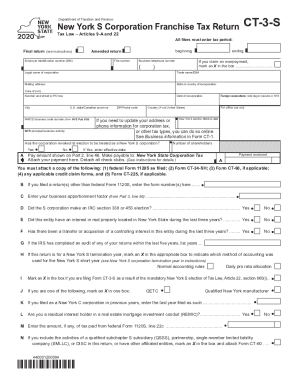

Tips on how to fill out, edit and sign NY DTF CT-3-S online

How to fill out and sign NY DTF CT-3-S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Today, most Americans would rather do their own income taxes and, moreover, to fill out forms in electronic format. The US Legal Forms online platform helps make the procedure of e-filing the NY DTF CT-3-S fast and hassle-free. Now it requires not more than 30 minutes, and you can do it from any place.

How you can fill up NY DTF CT-3-S fast and easy:

-

Open up the PDF blank in the editor.

-

Refer to the outlined fillable fields. This is where to place your information.

-

Click on the option to choose if you see the checkboxes.

-

Proceed to the Text icon and also other powerful functions to manually change the NY DTF CT-3-S.

-

Confirm all the information before you resume signing.

-

Create your exclusive eSignature using a key-board, digital camera, touchpad, computer mouse or cell phone.

-

Certify your PDF form online and specify the particular date.

-

Click on Done proceed.

-

Save or deliver the file to the receiver.

Be sure that you have filled in and delivered the NY DTF CT-3-S correctly in due time. Consider any applicable term. If you give incorrect info with your fiscal papers, it can result in significant fees and create problems with your annual income tax return. Be sure to use only qualified templates with US Legal Forms!

How to edit NY DTF CT-3-S: customize forms online

Choose a rock-solid file editing service you can trust. Edit, complete, and sign NY DTF CT-3-S safely online.

Too often, working with forms, like NY DTF CT-3-S, can be pain, especially if you received them in a digital format but don’t have access to specialized tools. Of course, you can find some workarounds to get around it, but you risk getting a form that won't meet the submission requirements. Using a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We provide a simpler and more efficient way of modifying forms. A comprehensive catalog of document templates that are straightforward to customize and certify, and make fillable for other people. Our platform extends way beyond a set of templates. One of the best aspects of using our option is that you can change NY DTF CT-3-S directly on our website.

Since it's an online-based option, it saves you from having to get any software program. Additionally, not all company policies permit you to install it on your corporate laptop. Here's how you can effortlessly and safely complete your paperwork with our solution.

- Hit the Get Form > you’ll be immediately taken to our editor.

- Once opened, you can kick off the customization process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Pick the date field to add a specific date to your template.

- Add text boxes, images and notes and more to complement the content.

- Use the fillable fields option on the right to create fillable {fields.

- Choose Sign from the top toolbar to generate and create your legally-binding signature.

- Hit DONE and save, print, and pass around or get the output.

Say goodbye to paper and other inefficient ways of modifying your NY DTF CT-3-S or other forms. Use our tool instead that includes one of the richest libraries of ready-to-customize forms and a robust file editing option. It's easy and safe, and can save you lots of time! Don’t take our word for it, try it out yourself!

Get form

Related links form

It gets added to the seller's other incomes and is taxed at the applicable slab rate. If the property was held for more than 3 years, then the gains are considered long-term capital gains (LTCG) and taxed at 20% with indexation. Mint Money explains the steps to calculate LTCG arising from transfer of assets.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.