Loading

Get Nm Trd Pit-x Instructions 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD PIT-X Instructions online

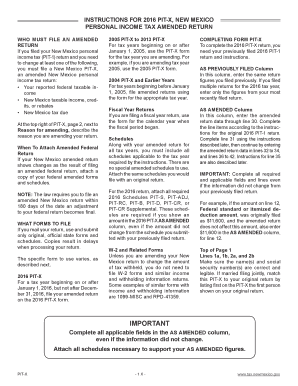

Filing an amended personal income tax return can be a complex task, but understanding the NM TRD PIT-X Instructions is essential for accurate submission. This guide provides clear, step-by-step instructions to help users effectively fill out the NM TRD PIT-X form online.

Follow the steps to complete the NM TRD PIT-X Instructions online:

- Click ‘Get Form’ button to acquire the NM TRD PIT-X form and display it in your editor.

- Enter your previously filed 2016 PIT-1 return figures in the AS PREVIOUSLY FILED column, ensuring you use data from your most recent return if multiple filings exist.

- Populate the AS AMENDED column with the new information you are reporting on the amended return, completing all relevant lines up to line 42.

- At the top of the form, confirm that the names, social security numbers, and residency statuses are accurate and legible.

- Indicate if the taxpayer or spouse qualifies as blind or is 65 years of age or older by marking the appropriate checkboxes.

- In lines 3a and 3b, input your current mailing address and check if any changes occurred since your last filing.

- Enter the reason for amending your return in the designated space on page 2, outlining the specific cause for your amendment.

- Complete the special instructions for line 31 and the accompanying schedule to reflect any other payments or refunds.

- Ensure signatures are included for all individuals who are filing jointly, and enter necessary identification numbers to help prevent identity theft.

- Review the completed form using the checklist provided at the end of the instructions to ensure all sections are filled out correctly.

- After verifying all information, you can save, download, print, or share your completed form as needed.

Start filing your NM TRD PIT-X online now for a smoother tax experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A CRS number in New Mexico consists of 11 digits and commonly follows a format starting with the letters 'CRS' followed by numbers. This unique identifier is critical for ensuring that your tax reporting aligns with state requirements. By following the NM TRD PIT-X Instructions, you can easily verify your CRS format and any details related to it. If needed, look to uslegalforms for further assistance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.