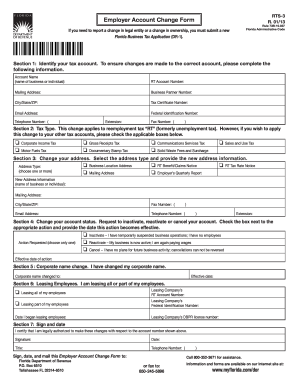

Get Fl Dor Rts-3 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR RTS-3 online

How to fill out and sign FL DoR RTS-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all the essential tax documents, including FL DoR RTS-3, is a responsibility solely held by US citizens. US Legal Forms simplifies your tax management, making it more attainable and precise.

Here’s how to prepare FL DoR RTS-3 online:

Safeguard your FL DoR RTS-3. Ensure that all your accurate documents and information are correctly organized while keeping in mind the deadlines and tax regulations established by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain FL DoR RTS-3 through your browser on your device.

- Click to access the editable PDF file.

- Start filling out the online template box by box, following the guidance of the sophisticated PDF editor’s user interface.

- Accurately enter text and figures.

- Select the Date field to automatically set today’s date or adjust it manually.

- Utilize the Signature Wizard to create your personalized e-signature and authenticate within moments.

- Refer to the IRS guidelines if you have any unresolved questions.

- Hit Done to preserve the modifications.

- Continue to print the document, save it, or share it via Email, SMS, Fax, USPS without leaving your browser.

How to modify Get FL DoR RTS-3 2013: customize forms online

Filling out documents is more convenient with intelligent online resources. Remove paperwork with easily accessible Get FL DoR RTS-3 2013 templates that you can modify online and print.

Preparing documents and forms should be simpler, whether it’s a daily responsibility or an occasional task. When someone has to submit a Get FL DoR RTS-3 2013, learning rules and guides on how to accurately fill out a form and what it needs can consume a lot of time and energy. However, finding the right Get FL DoR RTS-3 2013 template makes document completion a breeze with a clever editor at your disposal.

Uncover a wider array of functionalities you can introduce to your document workflow. No need to print, complete, and annotate forms by hand. With a smart editing platform, all the vital document processing capabilities will always be accessible. If you aim to enhance your workflow with Get FL DoR RTS-3 2013 forms, locate the template in the catalog, select it, and uncover a more straightforward method of filling it out.

The more tools you master, the simpler it is to handle Get FL DoR RTS-3 2013. Explore the solution that offers everything you need to find and modify forms within one browser tab and say goodbye to manual paperwork.

- If you wish to insert text in a random section of the form or include a text field, utilize the Text and Text field features to expand the text within the form as extensively as needed.

- Make the most of the Highlight feature to emphasize the key elements of the form. If you wish to obscure or eliminate certain text segments, employ the Blackout or Erase features.

- Personalize the form by integrating standard graphic elements. Utilize the Circle, Check, and Cross tools to add these components to the forms when necessary.

- If you require additional notes, take advantage of the Sticky note option and place as many notes on the forms page as needed.

- If the form requires your initials or date, the editor provides tools for that as well. Reduce the chance of mistakes with the Initials and Date tools.

- You can also incorporate custom graphic elements into the form. Use the Arrow, Line, and Draw tools to personalize the file.

Get form

Related links form

The Florida Department of Revenue may send you a letter for various reasons, such as updates on your tax account, issues with your filings, or requests for additional information. It is essential to read the letter carefully and respond promptly. If needed, you can seek assistance regarding the FL DoR RTS-3 to address any concerns raised in the correspondence.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.