Get Wi P-626 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

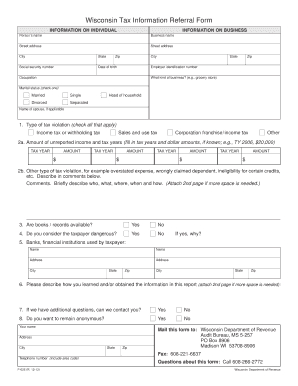

Tips on how to fill out, edit and sign WI P-626 online

How to fill out and sign WI P-626 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing tax forms can turn into a significant barrier and a major source of stress if appropriate guidance is not provided. US Legal Forms is designed as an online solution for WI P-626 electronic filing and offers numerous benefits for taxpayers.

Utilize the advice on how to fill the WI P-626:

Use US Legal Forms to ensure a smooth and straightforward completion of the WI P-626.

- Acquire the template from the website in the relevant section or using the Search engine.

- Press the orange button to access it and wait until it is fully loaded.

- Review the template and follow the instructions. If you have never filled out the template previously, adhere to the step-by-step guidance.

- Focus on the yellow fields. These are editable and need specific information to be entered. If you are uncertain what details to provide, consult the instructions.

- Always sign the WI P-626. Utilize the integrated tool to generate the electronic signature.

- Click on the date field to automatically insert the correct date.

- Revisit the sample to verify and modify it prior to submission.

- Click the Done button in the top menu once you have finished it.

- Save, download, or export the finalized template.

How to Alter Get WI P-626 2013: Modify Forms Online

Utilize the right document management resources at your disposal. Complete Get WI P-626 2013 with our reliable tool that merges editing and eSignature capabilities.

If you aim to execute and authenticate Get WI P-626 2013 online effortlessly, then our online cloud-based solution is the optimal choice. We provide an extensive template-based library of ready-to-use forms that you can alter and finish online. Furthermore, there’s no need to print the document or rely on third-party tools to make it fillable. All the essential features will be accessible once you open the document in the editor.

Let’s explore our online editing features and their primary attributes. The editor presents an intuitive interface, so it won’t take much time to master how to utilize it. We will review three key sections that enable you to:

In addition to the features outlined above, you can secure your file with a password, apply a watermark, convert the document to the desired format, and much more.

Our editor simplifies completing and certifying the Get WI P-626 2013 effortlessly. It enables you to carry out nearly everything concerning form management. Additionally, we always ensure that your experience modifying documents is safe and compliant with leading regulatory standards. All these aspects make using our solution even more pleasant.

Obtain Get WI P-626 2013, implement the necessary modifications and adjustments, and download it in the preferred file format. Try it out today!

- Modify and annotate the template

- The top toolbar offers features that assist you in highlighting and obscuring text, without images and visual elements (lines, arrows, checkmarks, etc.), add your signature, initialize, date the form, and more.

- Organize your documents

- Utilize the toolbar on the left if you wish to rearrange the form and/or remove pages.

- Prepare them for distribution

- If you want to create a fillable document for others and share it, you can use the tools on the right to insert various fillable sections, signature, date, text boxes, etc.

Get form

Related links form

Yes, many post offices carry tax forms, including the WI P-626 for Wisconsin residents. While not every location may have all forms, they often stock popular items during tax season. It can be a good idea to call ahead to check for availability if you prefer to pick up your forms in person.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.