Get Ttb F 5130.9 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TTB F 5130.9 online

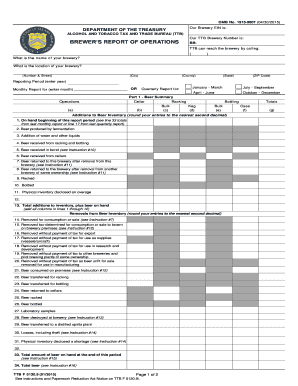

The TTB F 5130.9, also known as the brewer’s report of operations, is a crucial document for breweries to report their production and inventory activities. Filling it out correctly is essential for compliance with federal regulations governing alcohol production.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your brewery's name in the designated field. This information identifies your brewing operation.

- Provide the address of your brewery, including the number and street, city, county, state, and zip code. Ensure all details are accurate to facilitate communication.

- Indicate the reporting period by entering the year and selecting the appropriate month for a monthly report, or choose the relevant quarter for a quarterly report.

- In Part 1, fill out the beer summary by recording all relevant values regarding cellar, racking, bottling, and total counts for each category.

- Complete the additions section by rounding entries to the nearest second decimal, beginning with inventory on hand from the previous report and including all production inputs.

- Proceed to the removals section and accurately report all beer removals based on specified categories, adhering to the guidelines provided in the instructions.

- If applicable, input prior period adjustments. This includes any additions or removals from previous reports that need to be accounted for.

- At the end of the form, declare under penalties of perjury that your report is complete and correct by providing your signature, title, and date.

- Once all fields are filled out, save your changes. You can download, print, or share the completed form as needed.

Complete your TTB F 5130.9 form online today to ensure compliance and accurate reporting.

The tax rate on beer can vary based on the volume produced and the specific type of beer. Generally, the first 60,000 barrels produced by a brewery may have a reduced rate, providing a financial incentive for smaller operations. It's important to reference the TTB F 5130.9 for the latest tax rates and regulations. This form can guide you through the complexities of beer taxation and ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.