Loading

Get Irs Notice 1036 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Notice 1036 online

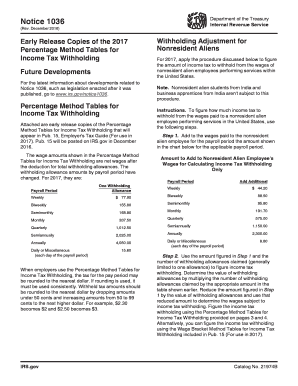

Filling out the IRS Notice 1036 is an essential step for employers to determine the correct income tax withholding using the Percentage Method Tables. This guide will walk you through the process of completing the form online in a clear and supportive manner.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the form’s instructions carefully. Familiarize yourself with the sections that pertain to the percentage method tables for income tax withholding, as these will guide your calculations.

- In the relevant section of the form, provide details such as the payroll period: weekly, biweekly, or monthly. Choose the applicable table based on this period.

- Input the employee’s wage amount and subtract withholding allowances to find the taxable income. Apply the appropriate percentage from the tables to determine the amount to withhold.

- If you are calculating for nonresident alien employees, ensure to add the necessary amount specified for their wages before calculating withholding.

- Double-check your entered figures for accuracy to minimize errors. Ensure all amounts are rounded correctly, adhering to the rounding rules outlined in the form.

- Once all sections are filled out accurately, you can save changes, download, print, or share the completed form as needed.

Complete the IRS Notice 1036 online today to ensure accurate tax withholding.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, the IRS offers options for one-time penalty relief under certain conditions. This relief is often granted to taxpayers who have a good compliance history but are facing difficulties. It’s advisable to reference IRS Notice 1036 to determine eligibility and strengthen your request for this one-time forgiveness program.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.