Get Ca Boe-502-a (p1) 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA BOE-502-A (P1) online

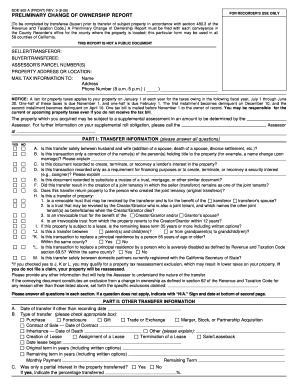

Completing the CA BOE-502-A (P1) form online is essential for facilitating property ownership transfers in California. This guide will walk you through each section of the form, ensuring that you understand what information is required and how to accurately fill it out.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the CA BOE-502-A (P1) form. This action will allow you to open and begin editing the document.

- Begin with the seller/transferor and buyer/transferee sections. Clearly enter the names of both parties involved in the property transfer.

- Fill out the assessor’s parcel number(s) and the property address or location. Ensure accuracy in these details as they are crucial for proper identification.

- Indicate where to mail tax information by providing the relevant address and contact details of the buyer or transferee.

- In Part I of the form, respond to all questions regarding the nature of the transfer. Answer each question with 'yes' or 'no.' If applicable, provide explanations where indicated.

- Proceed to Part II and include details about the type of transfer, the date, and any specifics that pertain to the transaction. Indicate if only a partial interest was transferred.

- For Part III, enter the purchase price details. Include cash down payment information, loan terms, and any special financing involved.

- In Part IV, provide information about the property's type, whether it will be a principal residence, and if any personal property is included in the sale.

- Complete the certification section, ensuring that all required signatures are provided. Include your name and position if applicable, and date the form.

- Once all fields are filled, review the form for accuracy. Save your changes, and then choose to download, print, or share the completed form as necessary.

Complete your CA BOE-502-A (P1) form online today for a smooth property transfer process.

Get form

To transfer ownership of a property in California, you typically need to complete a grant deed or quitclaim deed, then file it with the county recorder's office. Ensure you meet all local requirements and deadlines to perfect the transfer. It’s critical to consider potential tax implications that may arise with the transfer. Utilizing CA BOE-502-A (P1) can provide clarity on the tax consequences and related applications.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.