Loading

Get Irs Instruction 1098-c 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1098-C online

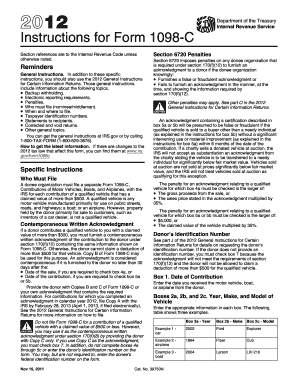

Filling out the IRS Instruction 1098-C can seem daunting, but this guide will help simplify the process. With clear, step-by-step instructions, you will learn how to accurately complete the form online for your vehicle contributions.

Follow the steps to successfully complete the IRS Instruction 1098-C.

- Press the ‘Get Form’ button to access the IRS Instruction 1098-C. This will open the form in your preferred online document editor to begin filling it out.

- Enter the date of contribution in Box 1. This is the date you received the motor vehicle, boat, or airplane from the donor.

- Complete Boxes 2a, 2b, and 2c by providing the year, make, and model of the qualified vehicle respectively.

- Input the Vehicle or Other Identification Number in Box 3. This can be found in the vehicle’s owner manual and is required for proper identification.

- If the vehicle is to be sold to a needy individual, check Box 5b. If not, move to the next step.

- If the vehicle is sold in an arm's length transaction, check Box 4a and complete this section along with Boxes 4b and 4c.

- Provide detailed descriptions in Box 5c about any material improvements or significant intervening use related to the vehicle.

- Indicate in Box 6a whether goods and services were provided in exchange for the vehicle. If yes, complete Box 6b and 6c with the estimated value and a description of those goods and services received.

- Finally, if the vehicle's claimed value is $500 or less, check Box 7. This indicates that you do not need to file Copy A with the IRS or furnish Copy B to the donor.

- Review all the information for accuracy. Once complete, you can save your changes, download, print, or share the form as needed.

Complete your IRS Instruction 1098-C online today for an efficient filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To submit your 1098-C to the IRS, you can either file it electronically or send a paper copy. If you are submitting electronically, ensure you use approved software that adheres to IRS guidelines. Remember, following the IRS Instruction 1098-C helps in ensuring that your submission is thorough and complies with current tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.