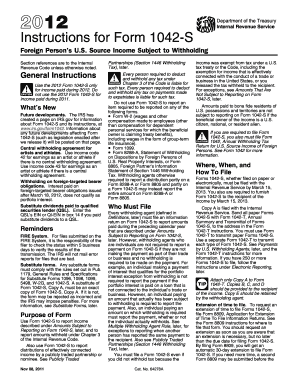

Get Irs Instruction 1042-s 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1042-S online

This guide provides a comprehensive overview of how to accurately complete the IRS Instruction 1042-S form online. It aims to support users with varying levels of experience by offering clear and detailed instructions for each section of the form.

Follow the steps to successfully fill out the IRS Instruction 1042-S.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the correct recipient information. Ensure to include the recipient's name, address, and taxpayer identification number, if available.

- In Box 1, enter the appropriate income code that reflects the type of income being reported. Refer to the income code list for accuracy.

- Next, provide the total gross income in Box 2 based on the amounts paid to the recipient during the reporting year.

- If applicable, complete Box 3 for withholding allowances, only if using income codes related to compensation.

- Enter the applicable tax rate in Box 5 that corresponds to the reported income. Refer to the valid tax rate table for guidance.

- If applicable, fill in Box 6 with the exemption code that corresponds to the income being reported. Ensure proper coding.

- Record the total federal tax withheld in Box 7. If no tax was withheld, indicate this clearly.

- If another withholding agent has withheld tax on the income, fill in Box 8 with the amount withheld by the prior agent.

- Ensure to provide the withholding agent’s information in Boxes 11-12, including the employer identification number (EIN).

- Finally, review all entered information for accuracy. Save the changes, then download, print, or share the form as needed.

Complete your IRS Instruction 1042-S form online today to ensure compliance and proper reporting.

Get form

Related links form

Reporting 1042-S income on TurboTax requires you to input the information from the form into the appropriate sections of your return. Although TurboTax may not directly support Form 1042-S, understanding IRS Instruction 1042-S will help you identify the correct way to categorize this income. Ensure you keep detailed records for accuracy. Consider platforms specifically designed for international tax forms for ease.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.