Loading

Get Irs Instruction 1040 Line 44 2015-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1040 Line 44 online

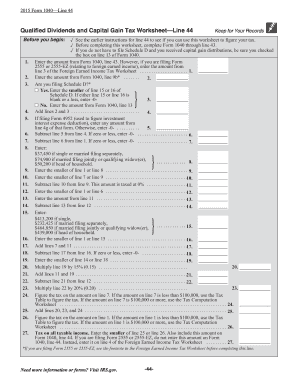

Filling out the IRS Instruction 1040 Line 44 accurately is essential for calculating your capital gain tax. This step-by-step guide will help you navigate through the process of completing this section online.

Follow the steps to complete Line 44 of IRS Instruction 1040.

- Use the 'Get Form' button to obtain the form and display it in your editor.

- Start by completing Form 1040 through line 43 before proceeding to Line 44.

- If you do not need to file Schedule D but received capital gain distributions, ensure that you have checked the box on line 13 of Form 1040.

- Enter the amount from Form 1040, line 43 in the designated field.

- Next, enter the amount from Form 1040, line 9b in the appropriate section.

- Determine if you are filing Schedule D. If yes, enter the smaller amount of line 15 or line 16 from Schedule D; if either is blank or a loss, enter -0-.

- If you are not filing Schedule D, enter the amount from Form 1040, line 13.

- Add the amounts from lines 2 and 3, and write that total.

- If filing Form 4952, enter any amount from line 4g of that form; otherwise, enter -0-.

- Subtract line 5 from line 4. If this result is zero or less, enter -0-.

- Next, subtract line 6 from line 1. If zero or less, enter -0-.

- Based on your filing status, enter the appropriate threshold amount.

- Enter the smaller of line 1 or line 8.

- Then, enter the smaller of line 7 or line 9.

- Subtract line 10 from line 9, which gives you the amount taxed at 0%.

- Enter the smaller of line 1 or line 6.

- Enter the amount from line 11.

- Subtract line 13 from line 12.

- Enter the appropriate threshold amount based on your filing status.

- Enter the smaller of line 1 or line 15.

- Add the amounts from lines 7 and 11.

- Subtract line 17 from line 16. If this result is zero or less, enter -0-.

- Enter the smaller of line 14 or line 18.

- Multiply line 19 by 15%, and write that result.

- Add lines 11 and 19.

- Subtract line 21 from line 12.

- Multiply line 22 by 20%, and document that figure.

- Figure the tax based on amount in line 7 or 1, using appropriate tables.

- Sum lines 20, 23, and 24.

- Finally, enter the smaller of line 25 or line 26 on Line 44 of Form 1040.

Complete the IRS Instruction 1040 Line 44 online now to ensure your taxes are filed accurately.

Rounding numbers for the IRS involves determining the right whole number for your entries. For any amount with 50 cents or more, round up; if it's below 50, round down. This method applies to all financial figures, including those required for IRS Instruction 1040 Line 44. Accuracy in rounding ensures compliance and clarity in your tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.