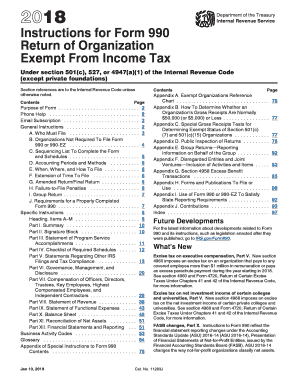

Get Irs 990 Instructions 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 Instructions online

How to fill out and sign IRS 990 Instructions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren’t linked to document handling and legal processes, submitting IRS paperwork will be incredibly challenging. We completely understand the importance of accurately completing forms.

Our web-based application offers the means to simplify the task of submitting IRS paperwork as smoothly as possible. Adhere to these instructions to accurately and swiftly fill out IRS 990 Guidelines.

Utilizing our service can certainly enable proficient completion of IRS 990 Guidelines. We will do everything to ensure your work is comfortable and secure.

- Choose the button Get Form to access it and start modifying.

- Complete all essential fields in your document using our user-friendly PDF editor. Activate the Wizard Tool to facilitate the process even more.

- Ensure the accuracy of the information provided.

- Add the date of submission for IRS 990 Guidelines. Utilize the Sign Tool to create your unique signature for document verification.

- Finish editing by selecting Done.

- Transmit this document directly to the IRS in the most convenient manner for you: via email, using online fax, or traditional postal service.

- You can print it on paper if a physical copy is needed and download or save it to your chosen cloud storage.

How to Modify Get IRS 990 Guidelines 2018: Tailor Forms Online

Maximize the use of our comprehensive online document editor while preparing your forms. Complete the Get IRS 990 Guidelines 2018, focusing on the most essential details, and effortlessly make any additional necessary alterations to its content.

Filling out documents electronically not only conserves time but also allows you to adjust the template according to your preferences. If you're preparing the Get IRS 990 Guidelines 2018, consider using our powerful online editing tools. Whether you encounter a typographical error or input the required information in the incorrect field, you can easily modify the document without needing to restart from the beginning as you would with manual completion.

Furthermore, you can highlight crucial information in your paperwork by accentuating specific sections with colors, underlining, or circling them.

Our extensive online services represent the most efficient method to complete and personalize the Get IRS 990 Guidelines 2018 according to your requirements. Use it to prepare both personal and business documents from any location. Open it in a browser, make necessary adjustments to your documents, and revisit them at any future time - all will be securely stored in the cloud.

- Access the form in the editor.

- Enter the necessary details in the empty fields using Text, Check, and Cross features.

- Follow the document navigation to ensure no required fields are overlooked.

- Circle some of the important details and add a URL to it if necessary.

- Utilize the Highlight or Line options to emphasize the most important facts.

- Choose colors and thickness for these lines to ensure your form appears professional.

- Erase or blackout the information that you want to remain hidden from others.

- Correct sections of content that have errors and replace them with the required text.

- Conclude modifications with the Done button after verifying that everything is accurate in the document.

Get form

Related links form

Organizations with gross receipts exceeding $200,000 or total assets exceeding $500,000 need to file the full IRS Form 990. Smaller organizations may qualify to file Form 990-EZ or the simpler Form 990-N. To understand these thresholds better, the IRS 990 Instructions provide detailed information on the filing requirements based on financial performance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.