Loading

Get Ar Attachment To Irs 990ez

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR Attachment to IRS 990EZ online

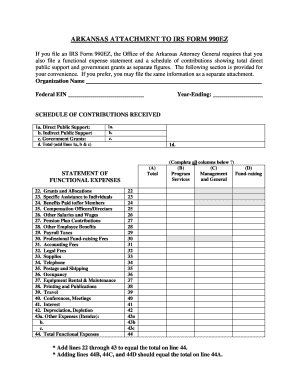

Filling out the Arkansas Attachment to IRS Form 990EZ is a crucial step for organizations to comply with state requirements. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the AR Attachment to IRS 990EZ online.

- Click ‘Get Form’ button to obtain the AR Attachment to IRS 990EZ and open it in your preferred online editor.

- Begin by entering your organization's name and Federal Employer Identification Number (EIN) at the top of the form. Ensure this information is accurate, as it identifies your organization.

- Next, indicate the year-ending for which you are filing the form.

- Fill out the Schedule of Contributions Received section. Start with 1a for Direct Public Support, followed by 1b for Indirect Public Support, and 1c for Government Grants. Provide the respective amounts in the empty fields.

- In line 1d, calculate the total contributions by adding lines 1a, 1b, and 1c.

- Move to the Statement of Functional Expenses section. Complete each line from 22 to 43, detailing expenses related to Grants and Allocations, Specific Assistance, Compensation, and various operational costs.

- Ensure the totals in the functional expenses section align correctly. Add lines 22 through 43 to equal the total on line 44.

- Verify that the totals from lines 44B, 44C, and 44D match the total on line 44A, confirming accuracy.

- Once all sections are completed, save your changes. You can download, print, or share the form as needed.

Start completing the AR Attachment to IRS 990EZ online today!

Related links form

Part III of the 990 Schedule D provides information about the organization's endowment fund. It requires organizations to disclose the specific characteristics and restrictions of their endowment funds. Understanding this section helps you accurately complete the AR Attachment to IRS 990EZ, which may be necessary if your organization has endowments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.