Loading

Get Dc Otr Fp 161 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC OTR FP 161 online

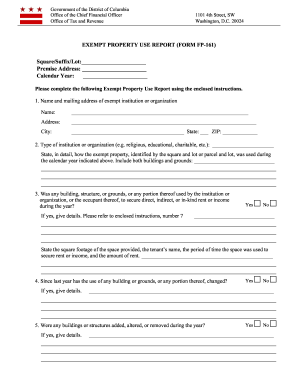

Filling out the DC OTR FP 161 Exempt Property Use Report online can be a straightforward process when you know the right steps to follow. This guide will walk you through each section of the form to ensure you provide the necessary information accurately and promptly.

Follow the steps to complete the Exempt Property Use Report effectively.

- Press ‘Get Form’ button to access the Exempt Property Use Report and open it for editing.

- Fill in the required information regarding the exempt institution or organization. Begin with the name and mailing address. Ensure that all fields are completed accurately, including the city, state, and ZIP code.

- Specify the type of institution or organization, such as religious, educational, or charitable. Further, provide a detailed account of how the exempt property was utilized during the specified calendar year, addressing both buildings and grounds.

- Answer the question regarding any use of property for generating rent or income. If applicable, provide specific details including the square footage of the utilized space, the name of any tenant, the duration of the agreement, and the total rent collected.

- Indicate any changes in property use since last year. If there were changes, please describe them in detail.

- State whether any buildings or structures were added, altered, or removed during the year, and furnish details where necessary.

- If you fall under Category II filers, complete Part II by identifying the relevant provision of the District of Columbia Official Code and describe the community benefits provided during the reporting year.

- Lastly, complete the affidavit section by providing your signature, name, title, daytime phone number, and the date. Double-check that all answers are complete before submitting.

- Once you have filled out the form, you can save changes, download a copy, print it for your records, or share it as needed.

Complete your Exempt Property Use Report online today to ensure compliance and avoid any penalties.

Submitting an expense report typically involves compiling your receipts and a summary of expenses in a structured format. Ensure you adhere to your employer's submission guidelines for accuracy. To streamline this process, consider using templates from USLegalForms that align with the DC OTR FP 161 requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.