Loading

Get Dc Otr Fp 161 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC OTR FP 161 online

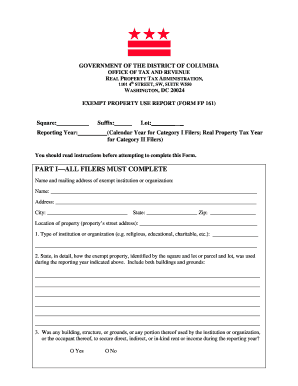

This guide provides detailed instructions on completing the Exempt Property Use Report (Form FP 161) online. Designed for a wide audience, this resource aims to help individuals and organizations understand the form's requirements and navigate the filling process with ease.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, enter the square and lot numbers for the property being reported. Indicate the reporting year, specifying whether it’s the calendar year for Category I filers or the real property tax year for Category II filers.

- Next, provide the name and mailing address of the exempt institution or organization. Ensure all address components are correctly filled, including city, state, and zip code.

- For the property location, input the street address accurately. Then, specify the type of institution or organization (e.g., religious, educational, charitable) in the provided field.

- Detail how the exempt property was utilized during the reporting year. This includes descriptions of the use of both buildings and grounds.

- Answer the question regarding whether any part of the property was used to secure rent or income. If the answer is 'yes,' provide detailed information in the subsequent fields.

- Indicate any changes in building use since the previous reporting year. If changes occurred, give details about those changes.

- State whether any buildings or structures were added, altered, or removed during the reporting year. If applicable, provide details regarding these alterations.

- If you are a Category II filer, complete Part II by identifying the provision of law granting exemption or abatement. Describe any community benefits provided during the reporting year.

- Complete the affidavit section by signing and printing your name, indicating your title and daytime phone number, and specifying the date.

- Finally, review all entered information for accuracy. Save your changes, and then download, print, or share the completed form as needed.

Complete your Exempt Property Use Report online today for timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

DC OTR stands for the District of Columbia Office of Tax and Revenue, the agency responsible for collecting taxes and managing the tax codes in D.C. Its main goal is to ensure that the city generates revenue to support public services while also providing resources to taxpayers. Understanding the role of DC OTR is crucial for utilizing programs like DC OTR FP 161 effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.