Loading

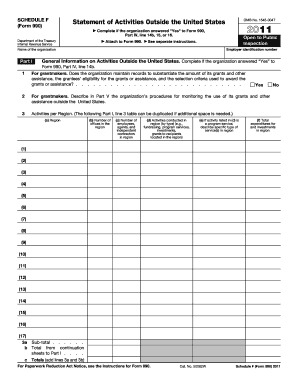

Get Irs 990 - Schedule F 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule F online

Filling out the IRS 990 - Schedule F is an essential process for organizations that conduct activities outside the United States. This guide provides step-by-step instructions to help you effectively complete the form online, ensuring compliance with tax reporting requirements.

Follow the steps to complete the IRS 990 - Schedule F online.

- Click ‘Get Form’ button to access the IRS 990 - Schedule F.

- Enter your organization's employer identification number and name at the top of the form. This ensures that your submission is properly attributed to your organization.

- In Part I, respond to the questions regarding general information on activities outside the United States, including whether your organization maintains records for grant making. Answer appropriately and describe the procedures in Part V if necessary.

- For listing activities by region in Part I, utilize the table provided to record the regions of operation, including the number of offices, employees, types of activities, and total expenditures.

- If applicable, complete Part II for grants and assistance provided to organizations outside the United States. You will need to enter details such as the name of the organization, purpose of the grant, and amounts disbursed.

- In Part III, fill out information about grants or assistance to individuals outside the United States. This includes providing similar details on the type of assistance and recipients.

- Review the questions in Part IV to determine if your organization has any foreign transfers or interests that may require additional forms to be filed. Answer each question truthfully.

- Complete Part V with any supplemental information required, ensuring to clarify monitoring procedures, accounting methods, and estimated numbers of recipients.

- Once all sections have been filled out accurately, save your changes. You can then download, print, or share the IRS 990 - Schedule F as required.

Start completing your IRS 990 - Schedule F online today to stay compliant with federal regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Organizations that carry out fundraising activities should file IRS 990 - Schedule F. This includes nonprofits and other tax-exempt groups seeking public contributions for support. Filing accurately is vital to show compliance with IRS regulations and demonstrate responsible use of funds.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.