Loading

Get Irs 990 - Schedule D 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule D online

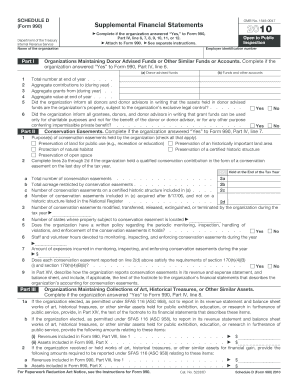

The IRS 990 - Schedule D is an essential supplement for organizations to provide detailed financial statements. This guide will support you in understanding each section of the form, ensuring you can complete it accurately and effectively online.

Follow the steps to fill out the IRS 990 - Schedule D online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, where you will need to provide details about donor advised funds or other similar accounts if applicable. Fill in the total number at year-end, aggregate contributions and grants made during the year, and confirm if all donors were informed about the organization’s control over the assets.

- In Part II, if applicable, outline conservation easements held by your organization. Mark the purpose of these easements and complete details regarding acreage, modifications, and the number of states involved.

- Part III is for organizations maintaining collections of art or historical assets. Indicate whether you are reporting these items and provide the revenue and assets included under that category.

- Proceed to Part IV if relevant, regarding escrow and custodial arrangements. Document details of any intermediary arrangements and the financial balances at both the beginning and end of the year.

- In Part V, if applicable, declare information concerning endowment funds. Record contributions, investments, and expected usage percentages over several years.

- Part VI is required for disclosures regarding land, buildings, and equipment. Provide the cost, accumulated depreciation, and book values in the relevant columns.

- Continue to Parts VII, VIII, and IX for investments in other securities, program-related investments, and other assets respectively, ensuring to include book values and valuation methods.

- In Part X, list other liabilities, including descriptions and corresponding amounts. Finish this section as per required disclosures, like the FIN 48 footnote.

- Finally, in Part XIV, supplement any information necessary for other sections, ensuring that all descriptions and additional notes are clearly stated.

- Once you have completed all sections, be sure to save the changes made to the form. You can then download, print, or share the completed IRS 990 - Schedule D as needed.

Complete your IRS 990 - Schedule D today to ensure accurate and timely online filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can access IRS Form 990 from the IRS’s official website or through tax preparation services that offer nonprofit solutions. Websites like uslegalforms provide user-friendly templates to help you complete the form accurately. Ensure you include the IRS 990 - Schedule D when applicable to provide a comprehensive overview of your organization’s finances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.