Get Irs 944-x 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

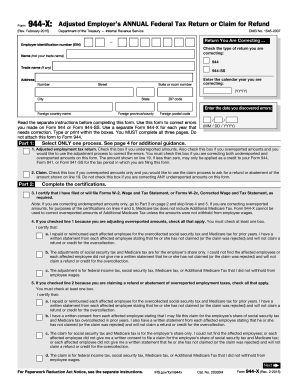

Tips on how to fill out, edit and sign IRS 944-X online

How to fill out and sign IRS 944-X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When people are not linked to documentation management and legal procedures, completing IRS forms can be rather tiresome.

We recognize the importance of accurately finalizing documents.

Using our service will facilitate professional completion of IRS 944-X. We will ensure everything is set for your ease and convenience.

- Click the button Get Form to launch it and start editing.

- Complete all necessary fields in the chosen document using our advanced PDF editor. Activate the Wizard Tool to make the process even easier.

- Verify the accuracy of the entered information.

- Include the date of filling IRS 944-X. Use the Sign Tool to create your unique signature for the document legalization.

- Conclude editing by clicking on Done.

- Submit this document directly to the IRS in the most convenient way for you: via email, using digital fax, or through postal service.

- You can print it on paper if a hard copy is required and download or save it to your preferred cloud storage.

Ways to modify Get IRS 944-X 2015: personalize forms online

Streamline your documentation workflow and tailor it to your preferences with just a few clicks. Complete and validate Get IRS 944-X 2015 using a detailed yet user-friendly online editor.

Creating documents is often tedious, especially when you deal with it sporadically. It requires you to meticulously follow all regulations and accurately fill in every section with complete and correct data. However, it's not uncommon to need to adjust the form or include additional fields for completion. If you wish to enhance Get IRS 944-X 2015 before submission, utilizing our extensive yet straightforward online editing tools is the optimal approach.

This comprehensive PDF editing utility allows you to swiftly and effortlessly finalize legal documents from any device connected to the web, make straightforward modifications to the form, and add more fillable sections. The service allows you to designate a specific area for each type of information, such as Name, Signature, Currency, and SSN, among others. You can set these as mandatory or conditional and assign responsibility for each field to a designated recipient.

Follow these steps to enhance your Get IRS 944-X 2015 online:

Our editor is a multi-functional online solution that can assist you in effortlessly and swiftly customizing Get IRS 944-X 2015 along with other templates to meet your needs. Minimize document development and submission duration while ensuring your paperwork appears professional without difficulty.

- Access the desired document from the directory.

- Complete the empty spaces with Text and use Check and Cross tools for the tickboxes.

- Utilize the right-side panel to edit the form with new fillable sections.

- Select the fields based on the category of information you wish to gather.

- Set these fields as required, optional, and conditional, and arrange their sequence.

- Assign each field to a particular individual using the Add Signer tool.

- Verify that all necessary changes have been made and click Done.

Get form

Related links form

Yes, you can file IRS 944-X electronically using IRS e-file services. Filing electronically is often more convenient, allowing for quicker submissions and confirmations. This method also reduces the likelihood of errors compared to paper filing. For assistance in the process, consider utilizing the comprehensive resources available at uslegalforms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.