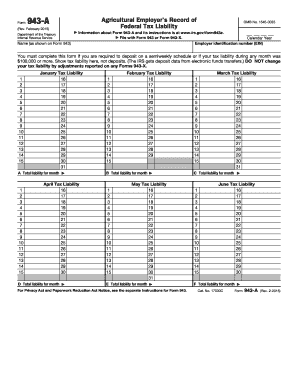

Get Irs 943-a 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 943-A online

How to fill out and sign IRS 943-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked with document administration and legal procedures, filling out IRS forms can be surprisingly tiring. We understand the importance of accurately completing paperwork.

Our web-based application provides the resources to make the process of handling IRS documents as straightforward as possible. Follow these guidelines to correctly and efficiently fill out IRS 943-A.

Utilizing our online application will transform professional completion of IRS 943-A into a reality, ensuring everything is set up for your convenience and ease of operation.

- Click on the button Get Form to access it and start editing.

- Complete all necessary fields in your document using our expert PDF editor. Activate the Wizard Tool to simplify the process even further.

- Verify the accuracy of the entered information.

- Add the date of submission for IRS 943-A. Use the Sign Tool to generate your personal signature for document validation.

- Conclude editing by clicking Done.

- Send this document to the IRS in the method that is most convenient for you: via email, using virtual fax, or through mail.

- You can print it on paper if a hard copy is required and download or save it to your preferred cloud storage.

How to Modify Get IRS 943-A 2015: Personalize Forms Online

Streamline your document creation process and tailor it to your needs within moments. Complete and sign Get IRS 943-A 2015 using a robust yet user-friendly online editor.

Creating documents is often challenging, especially when you handle them occasionally. It requires you to thoroughly comply with all procedures and precisely complete all sections with full and accurate information. Nevertheless, it frequently occurs that you need to modify the form or add additional sections for completion.

If you need to refine Get IRS 943-A 2015 before submitting it, the most efficient way to do so is by utilizing our powerful yet simple online editing tools.

This all-encompassing PDF editing tool enables you to effortlessly and swiftly complete legal documents from any internet-enabled device, perform essential modifications to the form, and integrate extra editable sections. The service allows you to select a specific area for each type of information, like Name, Signature, Currency, and SSN, etc. You may make them obligatory or conditional and designate who should complete each field by assigning them to a specified recipient.

Our editor is a flexible, feature-rich online solution that assists you in easily and swiftly adapting Get IRS 943-A 2015 along with other templates according to your needs. Enhance document preparation and submission times and create professional-looking forms without difficulty.

- Access the required file from the directory.

- Fill in the gaps with Text and use Check and Cross tools for the checkboxes.

- Utilize the panel on the right to modify the template with new editable sections.

- Select the areas based on the type of information you wish to collect.

- Designate these fields as mandatory, optional, and conditional and customize their sequence.

- Assign each area to a specific individual using the Add Signer option.

- Ensure that you've made all necessary changes and click Done.

Get form

When mailing your IRS 944 without payment, refer to the specific address indicated on the form’s instructions, which is based on your state. Just like with IRS 943-A, the proper mailing address is vital for prompt and accurate processing. The resources provided by uslegalforms simplify finding the right mailing address and gathering necessary forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.