Loading

Get Tx Comptroller 50-144 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

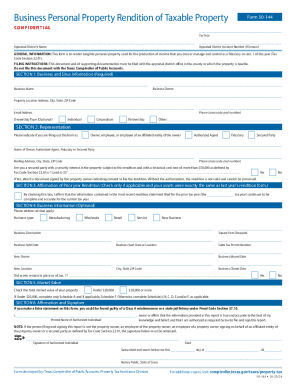

Filing the TX Comptroller 50-144 form is crucial for reporting tangible personal property used for income production. This guide will assist you in understanding the form's components and provide step-by-step instructions for successfully completing it online.

Follow the steps to fill out the TX Comptroller 50-144 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the general information, including the tax year and the appraisal district’s name. If known, include the appraisal district account number.

- In Section 1, provide the business name and owner information, as well as the property location address, email address, and ownership type if applicable.

- In Section 2, indicate the type of representation you are filing under, such as corporation or partnership, and provide your contact information.

- If applicable, check the box in Section 3 to affirm that your prior year rendition remains accurate.

- Complete Section 4 regarding business information, including business type and description, sales tax permit number, and dates pertinent to the business operation.

- In Section 5, check the total market value of your property, selecting 'Under $20,000' or '$20,000 or more' and complete the corresponding schedules.

- Fill out the affirmation and signature section in Section 6, ensuring all required fields are completed. If necessary, secure a notarized signature.

- Review all entries for accuracy and completeness before final submission. Save any changes made.

- Download, print, or share the completed form as needed. Ensure it is filed with the appropriate appraisal district office.

Complete your TX Comptroller 50-144 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Seniors who fill out Form 1040SR must take the standard deduction. Remember that if you're 65 or over, you are entitled to an additional $1,300. For an individual, that would raise the standard deduction to $13,300 for the tax year 2019, the first year that you can use the form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.