Get Tx Form 4108 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 4108 online

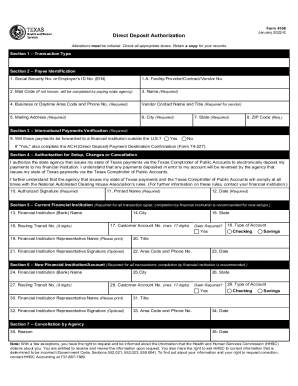

This guide provides a clear, step-by-step process for filling out the TX Form 4108 online, ensuring that users can navigate the form with confidence. Whether you are setting up, changing, or canceling a direct deposit, this guide will help you complete the form accurately.

Follow the steps to complete the TX Form 4108 online effectively.

- Click ‘Get Form’ button to obtain the TX Form 4108 and open it in the editor.

- In Section 1, select the appropriate transaction type: New Setup, Cancellation, or Change. Check all relevant boxes.

- Move to Section 2, Payee Identification. Enter your nine-digit Social Security Number or Employer's ID Number, along with any applicable Facility/Provider/Contract/Vendor number. Provide your name, business/organization contact, and contact details.

- In Section 3, answer the question regarding whether payments will be forwarded to a financial institution outside the U.S. If 'Yes', ensure to complete the ACH Payment Destination Confirmation (Form 74-227).

- Proceed to Section 4, where you need to provide your authorized signature, name, and the date. This section authorizes the setup, change, or cancellation of direct deposit instructions.

- Complete Section 5, Current Financial Institution, with details of your financial institution, including routing number and account number. It’s recommended that a financial institution representative assists in this section.

- If applicable, move to Section 6 to provide information about a new financial institution/account, ensuring all required fields are filled. Assistance from the financial institution representative is also recommended here.

- Finally, review all entries in each section for accuracy and completeness. Save your changes, and options to download or print the completed form will be available for your records.

Complete your TX Form 4108 online today to ensure your direct deposit is processed efficiently.

Related links form

To obtain a certificate of no tax due in Texas, you must first ensure that you have filed your TX Form 4108 and that your business has no outstanding tax obligations. You can request the certificate through the Texas Comptroller’s office either online or via mail. The US Legal Forms platform offers resources to streamline this process and ensure you have all the necessary documents ready for submission.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.