Loading

Get Tx Comptroller Ap-201 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller AP-201 online

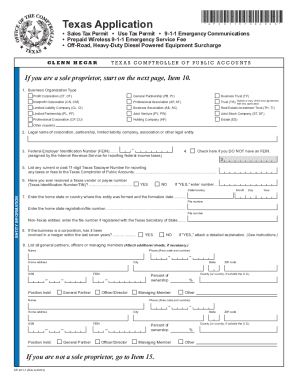

The TX Comptroller AP-201 is an essential document for individuals and businesses seeking a sales tax permit or use tax permit in Texas. This guide provides clear, step-by-step instructions for completing the form online, making the process as straightforward as possible.

Follow the steps to successfully complete the TX Comptroller AP-201 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the type of business organization you have. This may include options such as corporation, general partnership, or limited liability company. Choose the appropriate type based on your business structure.

- Enter the legal name of your corporation, partnership, or other legal entity in the specified field. If you do not have a Federal Employer Identification Number (FEIN), check the appropriate box.

- If applicable, provide your FEIN. This number is essential for reporting federal income taxes.

- List any Texas Taxpayer Numbers you have previously received, if applicable.

- Indicate whether you have received a Texas vendor or payee number. If you have, enter your Texas Identification Number (TIN) in the given space.

- Complete the entity information, including the home state or country where your entity was formed and the formation date, along with the registration or file number from your home state.

- If your business is a corporation, answer whether it has been involved in a merger within the last seven years. If yes, provide an explanation as required.

- List all general partners, officers, or managing members of the business, providing necessary details such as name, phone number, and address.

- Sole proprietors should fill out their personal information, including legal name and Social Security Number (if available). If you do not have an SSN, check the appropriate box.

- Proceed to the mailing address section, where you provide the primary business address for correspondence, ensuring to include all relevant details.

- After filling out the contact information, ensure all additional relevant sections, such as places of business and activities within Texas, are completed as necessary.

- Finally, review all information for accuracy. Once complete, save your changes, download the form, and print or share it as needed.

Complete your TX Comptroller AP-201 online today for a streamlined application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Reseller permits are distributed by the State and allow: Retailers and wholesalers to purchase items for resale without paying sales tax. Manufacturers to purchase ingredients or components that are used to create a new article for sale without paying sales tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.