Loading

Get Get Irs 941 - Schedule B 2017 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Get IRS 941 - Schedule B 2017 online

Filling out the Get IRS 941 - Schedule B 2017 form online can seem daunting, but with clear guidance, you can complete it efficiently. This guide provides step-by-step instructions to help you understand and fill out each section of the form thoroughly.

Follow the steps to accurately complete the form

- Press the ‘Get Form’ button to access the form and open it in your preferred digital editor.

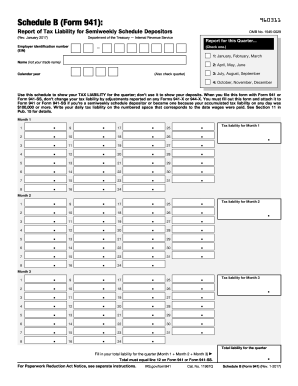

- Begin by entering your employer identification number (EIN) at the top of the form. This unique number is essential for accurately reporting your tax liabilities.

- Select the quarter for which you are reporting by checking the appropriate box (1 through 4) corresponding to the months involved. Options include January to March, April to June, July to September, and October to December.

- In each section designated for the three months, document your daily tax liabilities in the numbered spaces according to when wages were paid. Ensure accuracy in these daily entries as they contribute to your total liabilities.

- After filling out the daily liabilities, sum the total liabilities for each month. Clearly write the total for Month 1, Month 2, and Month 3 in the respective fields.

- Finally, sum the totals from all three months to compute your total liability for the quarter. This number must match line 12 on Form 941 or Form 941-SS for consistency.

- Once you have completed the form, save your changes, and then you can download, print, or share the document as needed.

Start completing your forms online today for a more efficient process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can indeed submit IRS Form 941 electronically through approved e-filing systems. This method is secure, quick, and ensures timely submission. To avoid any mistakes, it's advisable to use reliable software that adheres to IRS requirements. USLegalForms streamlines this process, making it easier for you to file your 941 electronically.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.