Loading

Get Irs 941 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941 online

The IRS 941 is an essential form for employers to report employment taxes. This guide provides clear, step-by-step instructions for completing the form online, ensuring you can submit it accurately and efficiently.

Follow the steps to complete the IRS 941 form online.

- Click 'Get Form' button to obtain the IRS 941 form and open it in your document editor.

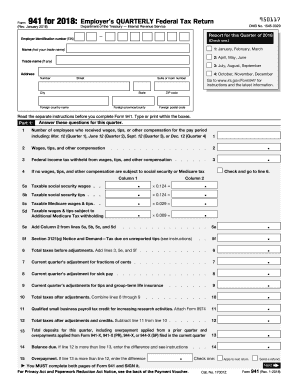

- Enter your employer identification number (EIN) in the designated field at the top of the form. Make sure to select the appropriate quarter that you are reporting for.

- Provide your name and trade name (if applicable) as required. Ensure that you fill in your address, including street number, city, state, and zip code.

- In Part 1, answer the questions regarding the number of employees who received wages and the total wages, tips, and other compensation for the quarter.

- Provide the federal income tax withheld from wages in the corresponding field. Ensure the amounts are accurate as they affect your liabilities.

- Report taxable social security wages and tips, along with taxable Medicare wages and any other relevant adjustments in Columns 1 and 2 of Part 1.

- Calculate total taxes before adjustments by adding the total from lines three, five e, and five f. Accurately adjust for fractions of cents and for sick pay, and calculate total taxes after adjustments.

- Complete Part 2 regarding your deposit schedule and tax liability for the quarter. Indicate whether you are a monthly or semiweekly schedule depositor.

- In Part 3, provide information about your business status, including whether you have stopped paying wages.

- Designate a third-party contact if desired, and complete the necessary details for your designee.

- Sign and date the form in Part 5, confirming the accuracy of the information provided, and make sure to include your title and best daytime phone number.

- Check that both pages of Form 941 are completed, and save your changes. You can now download, print, or share your completed form as needed.

Complete your IRS 941 filing online today to ensure timely and accurate reporting of your employment taxes.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filing your final IRS form 941, you should attach a statement indicating that this is your final return. This statement will confirm that you will no longer have any employees and that your business is closing or ceasing operations. Clarity in your filings helps to prevent confusion with the IRS and ensures your records are up-to-date.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.