Loading

Get Irs 941 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941 online

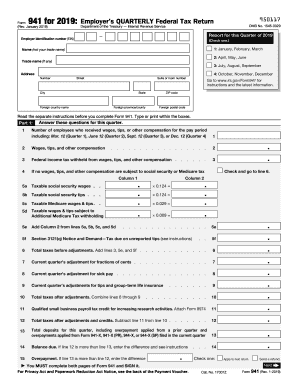

The IRS 941 form is essential for employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This guide will provide you with step-by-step instructions to help you accurately complete the form online.

Follow the steps to successfully fill out the IRS 941 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer identification number (EIN) in the designated field. Ensure to check which quarter you are reporting for: 1 (January to March), 2 (April to June), 3 (July to September), or 4 (October to December). Fill in your name and trade name if applicable, along with your address including city, state, ZIP code, and any foreign postal information if necessary.

- In Part 1, answer the required questions about the number of employees who received wages, tips, or other compensation during the pay period including the reference date (e.g., March 12 for quarter 1). Record the total wages, tips, and other compensation in the specified fields.

- Continue filling out line 3 for federal income tax withheld, and check line 4 if no wages or tips are subject to social security or Medicare tax.

- Complete lines 5a through 5f to provide information about taxable social security wages, tips, and Medicare wages and tips. Ensure accuracy in reporting amounts applicable to additional Medicare tax.

- Calculate total taxes before adjustments on line 6 by summing lines 3, 5e, and 5f.

- Fill out lines 7, 8, and 9 for any current quarter adjustments. Ensure to check columns for adjustments for fractions of cents, sick pay, and any group-term life insurance.

- On line 10, calculate total taxes after adjustments by combining lines 6 through 9.

- Record the qualified small business payroll tax credit if applicable on line 11 and subtract from total taxes on line 12.

- In Part 2, indicate whether you are a monthly or semiweekly schedule depositor and report your tax liabilities for the quarter.

- In Part 3, provide information about your business operations, including if you have closed your business or if you are a seasonal employer.

- In Part 4, indicate whether you authorize a third party to discuss the return with the IRS by providing the required name and phone number.

- You MUST complete both pages of Form 941. Sign and date the form in Part 5, ensuring all information is accurate to the best of your knowledge.

- Once all fields are completed, save your changes, and choose to download, print, or share the form as needed.

Complete your IRS 941 form online today for a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you have no employees, you generally don’t need to file IRS 941. Instead, you may need to consider other forms, such as Form 944, depending on your specific circumstances. It’s always best to review IRS guidelines or consult with a tax advisor to ensure compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.