Get Irs 8917 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8917 online

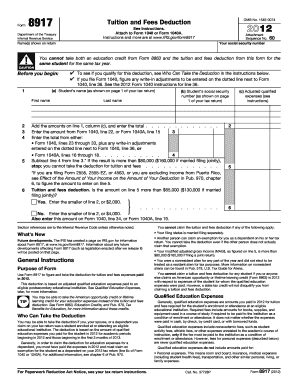

Filling out the IRS Form 8917 is essential for those seeking to claim the tuition and fees deduction. This guide provides a clear and methodical approach to filling out the form online, ensuring that you can maximize your benefits from qualified education expenses.

Follow the steps to accurately complete Form 8917 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number at the top of the form, followed by the names shown on your tax return in the designated fields.

- For line 1, provide the student's name and social security number, as well as the amounts related to adjusted qualified expenses in the required columns.

- Proceed to total the adjusted qualified education expenses for all applicable students on line 2.

- Enter the amount from Form 1040 or Form 1040A corresponding to your total income on line 3.

- From the total income entered in line 3, complete line 4 by subtracting any write-in adjustments according to the instructions provided.

- If the result from line 4 exceeds the specified thresholds, you will not be eligible for the deduction, and you must indicate this appropriately.

- If eligible, enter the deduction amount based on the income bracket on line 5. Ensure that you also transfer this amount to the corresponding line on your Form 1040.

- Review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your IRS 8917 form online today to take advantage of your eligible education deductions.

Get form

The maximum income limit for the American Opportunity Credit changes based on filing status. For single filers, the phase-out begins at an adjusted gross income of $80,000, while joint filers start at $160,000. You cannot claim the credit if your income exceeds these limits. Understanding these thresholds is crucial for effectively utilizing IRS 8917 to maximize your educational credits.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.