Get The Salvation Army Valuation Guide For Donated Items

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the The Salvation Army Valuation Guide for Donated Items online

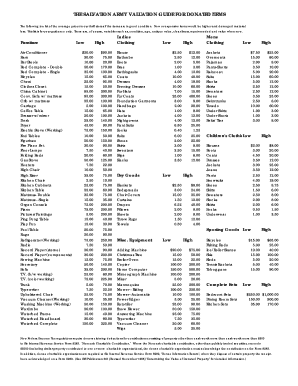

The Salvation Army Valuation Guide for Donated Items provides essential information on valuing various items you wish to donate. This guide will assist you in navigating the online process to complete the valuation form accurately and efficiently.

Follow the steps to complete the valuation guide online.

- Select the ‘Get Form’ button to access the valuation guide document and open it for editing.

- Review the list of item categories provided in the guide, such as furniture, clothing, and electronics. Identify the specific items you are donating and check their corresponding values.

- For each item, evaluate its condition based on the guidance given in the document—items in good condition will be valued at the higher range, while damaged items will be valued lower.

- Fill in the necessary fields regarding each item being donated. Include detailed information about the item type, description, and its estimated value as per the guide.

- Ensure that all items listed on the form correspond with the values you’ve assessed from the guide. If there are multiple items of the same type, summarize them to streamline the process.

- After filling out all necessary fields, review your entries for accuracy. Make sure to check that all items are included and valued appropriately.

- Once satisfied with the completed valuation, you can save changes, download the document for your records, print a copy, or share it as needed.

Start valuing your donated items online now!

Most of the contributions received by The Salvation Army go directly to relief efforts, with a significant percentage dedicated to programs and services. They are committed to transparency, which is why you should look into their annual reports for detailed financial information. By donating to The Salvation Army, you can trust that your support effectively contributes to relief efforts in your community. Knowing this can provide peace of mind as you consider your charitable giving.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.