Get Irs 8854 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8854 online

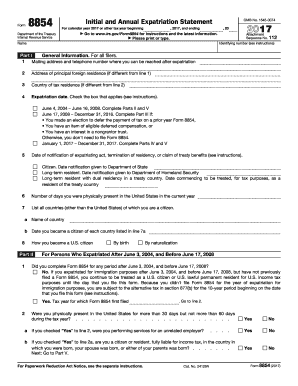

The IRS 8854 form, also known as the Initial and Annual Expatriation Statement, is required for individuals who have expatriated from the United States. This guide provides clear, step-by-step instructions for completing the form online, ensuring that users understand each section and field.

Follow the steps to accurately complete the IRS 8854 form online.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- In Part I, provide your general information. Input your mailing address and telephone number where you can be reached after your expatriation. If you have a different principal foreign residence, note that as well.

- In line 3, indicate your country of tax residence if it differs from your principal foreign residence. Fill in the date of expatriation and check the appropriate box as specified in the form instructions.

- Complete lines 5 to 8 with details about your citizenship in other countries, how you became a U.S. citizen, and your physical presence in the United States for the tax year.

- If you expatriated after June 16, 2008, proceed to Part III. Fill in the required sections about any deferred compensation and your tax liability in relation to your expatriation.

- For those expatriating during 2017, complete Part IV by listing your U.S. income tax liability for the five tax years before expatriation, along with your net worth on the date of expatriation.

- In Part V, provide a balance sheet and income statement. List all assets and liabilities with their fair market values and adjusted bases as of the specified date. Ensure you accurately report all sources of income within the required time frame.

- Finally, review all entries for accuracy, save your changes, and then download, print, or share the completed form for submission.

Start filling out your IRS 8854 form online today for a smooth expatriation process.

Get form

Related links form

No, Form 8854 cannot be filed electronically; it needs to be submitted in paper format. This form is essential for individuals going through expatriation and requires detailed reporting of assets and tax compliance. To ensure your submission is complete and accurate, consider using platforms like USLegalForms, which can guide you through the process. Filing by mail allows you to provide necessary signatures and supporting documents.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.