Get Irs 8853 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8853 online

How to fill out and sign IRS 8853 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't linked to document management and legal procedures, submitting IRS forms will be profoundly challenging. We comprehend the importance of accurately completing documents.

Our service provides the solution to make the process of handling IRS documents as straightforward as possible. Adhere to these instructions to accurately and swiftly complete IRS 8853.

Utilizing our comprehensive solution will facilitate the professional completion of IRS 8853. Make everything for your convenience and ease of work.

- Select the button Get Form to access it and start editing.

- Complete all mandatory fields in your document with our expert PDF editor. Activate the Wizard Tool to simplify the process significantly.

- Ensure the accuracy of the entered information.

- Add the date for completing IRS 8853. Use the Sign Tool to create a unique signature for the document's validation.

- Conclude your modifications by clicking Done.

- Transmit this document directly to the IRS in the most convenient way for you: via email, using virtual fax, or through traditional mail.

- You can print it on paper if a copy is required and download or save it to your chosen cloud storage.

How to modify Get IRS 8853 2015: personalize forms online

Utilize our extensive editor to transform a basic online template into a finalized document. Continue reading to discover how to modify Get IRS 8853 2015 online effortlessly.

Once you locate a suitable Get IRS 8853 2015, all you need to do is tailor the template to your requirements or legal standards. Besides completing the fillable form with precise information, you might want to exclude certain provisions in the document that are irrelevant to your situation. Alternatively, you may wish to incorporate some missing terms in the original template. Our sophisticated document editing capabilities are the easiest method to alter and amend the form.

The editor permits you to change the content of any form, even if the document is in PDF format. You can insert and eliminate text, add fillable fields, and execute additional changes while maintaining the initial formatting of the document. Furthermore, you can rearrange the layout of the document by altering the page order.

You do not need to print the Get IRS 8853 2015 to sign it. The editor includes electronic signature functionality. Most of the forms already possess signature fields. Thus, you only need to append your signature and request one from the other signing party via email.

Follow this step-by-step guide to generate your Get IRS 8853 2015:

Once all parties finalize the document, you will obtain a signed copy which you can download, print, and distribute to others.

Our services allow you to save a significant amount of time and reduce the chance of errors in your documents. Enhance your document workflows with efficient editing tools and a robust eSignature solution.

- Access the chosen template.

- Utilize the toolbar to modify the form to your liking.

- Complete the form with accurate details.

- Click on the signature field and add your eSignature.

- Send the document for signature to other signers if necessary.

Get form

Related links form

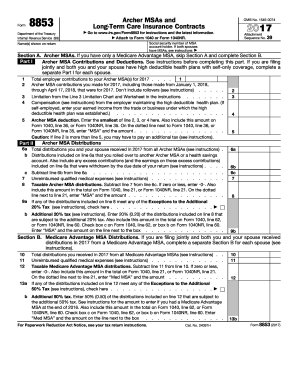

You must file IRS Form 8853 if you are reporting distributions from a health savings account, particularly if these distributions were used for qualified long-term care services. This form ensures compliance and accuracy in reporting benefits received. If you are uncertain about your eligibility, consider using US Legal Forms for guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.