Loading

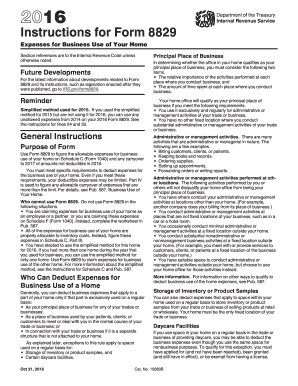

Get Irs 8829 Instructions 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8829 Instructions online

Filling out the IRS 8829 form accurately is crucial for calculating the allowable expenses for the business use of your home. This guide provides a straightforward approach to navigating the form efficiently, ensuring compliance with IRS requirements.

Follow the steps to fill out the IRS 8829 Instructions.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate online editor.

- Review the general instructions and ensure you meet the requirements to deduct expenses related to the business use of your home.

- Complete Part I by entering the area of your home used for business on lines 1 and 2, ensuring you accurately figure your business percentage.

- In Columns (a) and (b), enter direct or indirect expenses related to the business use of your home. Include only the relevant expenses paid for the portion of the year you used your home for business.

- If applicable, calculate the business percentage for specific daycare facilities as instructed and include this in your calculations.

- Proceed to Part II, where the gross income related to the business use of your home is calculated. Ensure all figures are accurate to reflect your situation.

- In Part III, provide the total cost or other basis of your home and land, along with any significant improvements made.

- Review lines 24 through 43 for potential carryovers and deductions, ensuring to attach relevant statements for clarity.

- Once completed, save changes to your document and consider downloading or printing for your records.

Complete your IRS forms online for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Deducting your home office on your taxes involves calculating your home office space and associated expenses. By using Form 8829, you can report these expenses under the home office deduction category. Always consult the IRS 8829 Instructions to avoid mistakes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.