Loading

Get Irs 8453-eo 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8453-EO online

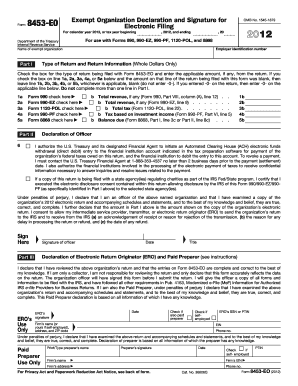

The IRS Form 8453-EO is an essential document for exempt organizations that are filing returns electronically. This guide provides step-by-step instructions for users to accurately complete the form online.

Follow the steps to fill out the IRS 8453-EO online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify your organization by filling in the name of the exempt organization and its employer identification number (EIN) in the designated fields.

- In Part I, check the appropriate box corresponding to the type of return you are filing (e.g., Form 990, Form 990-EZ, etc.). Enter the applicable amount from the return in the space provided, ensuring that you do not complete more than one line.

- Proceed to Part II, where the authorized officer must enter their declaration. The officer should certify to the IRS about the return's accuracy and validate any electronic payment authorizations if applicable.

- In Part III, if you have engaged a paid preparer or an electronic return originator (ERO), they must complete this section. Ensure all necessary signatures are obtained, with the ERO and preparer providing their identification numbers.

- Review all entries for accuracy. Save the completed form, and prepare to transmit it along with your electronically filed return using your tax preparation software.

- Once the form is finalized, you can save changes, download it, print it, or share it as needed before submission.

Ensure your compliance by filing the IRS 8453-EO online with the necessary attachments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To submit a power of attorney to the IRS, you must complete Form 2848. This form authorizes an individual to represent you before the IRS. You can e-file this form, or if preferred, mail it directly to the IRS. If you need help understanding this process, US Legal Forms has resources that can guide you through submitting the power of attorney effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.