Get Irs 8379 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

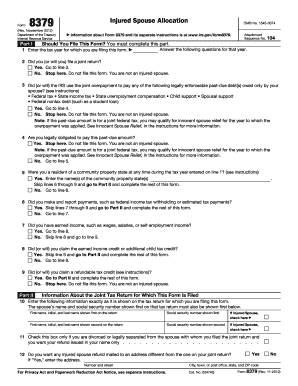

Tips on how to fill out, edit and sign IRS 8379 online

How to fill out and sign IRS 8379 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to document handling and legal procedures, completing IRS forms can be rather taxing. We understand the importance of properly finalizing documents.

Our platform offers the ideal solution to streamline the process of submitting IRS forms as effortlessly as possible. Adhere to this guide to swiftly and accurately complete IRS 8379.

Utilizing our robust solution will turn professional filling of IRS 8379 into a reality. We will do everything for your ease and swift performance.

- Select the button Get Form to access it and start editing.

- Fill in all required fields in your document using our professional PDF editor. Activate the Wizard Tool to make the process much simpler.

- Ensure the accuracy of the entered information.

- Include the submission date for IRS 8379. Use the Sign Tool to create your personal signature for document validation.

- Finish editing by clicking on Done.

- Send this document to the IRS in the most convenient manner for you: via email, using digital fax, or postal service.

- You can print it on paper if a hard copy is necessary and download or save it to your chosen cloud storage.

How to modify Get IRS 8379 2012: personalize forms online

Your readily adjustable and configurable Get IRS 8379 2012 template is within simple reach. Utilize our assortment with an integrated online editor.

Do you delay preparing Get IRS 8379 2012 because you just don't know where to start and how to proceed? We comprehend your emotions and have a fantastic solution for you that has nothing to do with combating your procrastination!

Our online collection of ready-to-use templates allows you to sift through and select from thousands of fillable forms suited for various applications and situations. But acquiring the form is just scratching the surface. We provide you with all the required tools to complete, certify, and modify the template of your choice without departing from our website.

All you need to do is access the template in the editor. Review the wording of Get IRS 8379 2012 and verify whether it's what you’re seeking. Begin adjusting the template by utilizing the annotation tools to give your document a more organized and tidy appearance.

Once you’re done modifying the template, you can download the document in any available format or select any sharing or delivery options.

With our fully-featured option, your finished documents will always be legally binding and completely encrypted. We assure you to protect your most sensitive information.

Obtain everything needed to produce a professional-looking Get IRS 8379 2012. Make the right choice and try our foundation now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, redact, and amend the current text.

- If the template is meant for additional users as well, you can incorporate fillable fields and distribute them for others to complete.

- A comprehensive suite of editing and annotation tools.

- A built-in legally binding eSignature capability.

- The capacity to create documents from scratch or based on the pre-designed template.

- Compatibility with a variety of platforms and devices for enhanced convenience.

- Numerous options for securing your documents.

- A range of delivery options for easier sharing and dispatching documents.

- Adherence to eSignature laws governing the usage of eSignature in online actions.

Get form

Related links form

The IRS form for spouse relief is IRS Form 8379. This form specifically helps individuals who are affected by their spouse's tax debts, allowing them to claim their rightful share of tax refunds. Using Form 8379 can provide you with financial relief if you find yourself in this challenging position. It’s an important tool for safeguarding your finances while addressing tax issues.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.