Get Irs 8082 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8082 online

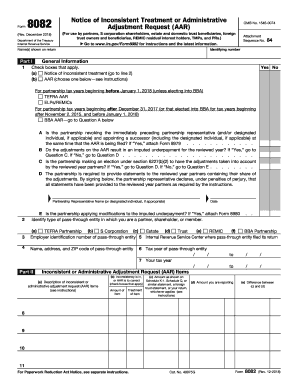

Filing Form 8082, the Notice of Inconsistent Treatment or Administrative Adjustment Request, is an important step for various stakeholders, including partners and shareholders in pass-through entities. This guide will assist you in completing the form efficiently and accurately in an online format.

Follow the steps to complete the IRS 8082 online.

- Press the ‘Get Form’ button to access the form and open it in your editing platform.

- In Part I, provide general information. Check the applicable box for either a notice of inconsistent treatment or an administrative adjustment request (AAR) and select the relevant type of AAR that applies to your situation.

- Complete the questions A through E as instructed, ensuring to provide necessary attachments like Form 8979 or Form 8980 where required.

- In Part II, enter the type of pass-through entity you are associated with, such as a TEFRA partnership or an S corporation, along with its employer identification number.

- Fill out the tax years for both the pass-through entity and your own tax year accurately.

- Inconsistent or AAR items are listed in Part II. For each item, provide a description, check the relevant inconsistencies, and detail amounts accordingly.

- Complete Part III by entering explanations for the items listed in Part II, making sure to reference the item numbers. Include any calculations related to the imputed underpayment.

- Finally, review your entries for accuracy. Once satisfied, you can save your changes, download the form, print, or share it as needed.

Complete your IRS forms online and ensure your submissions are accurate and timely.

The IRS typically takes about 8 to 12 weeks to process amendments, although this may vary based on their workload. Once you file your amended return, including any associated forms like IRS 8082, you can check the status online. Timely submission can help you receive a quicker response, maintaining your compliance with tax obligations. Staying informed about the process can alleviate anxiety as you wait for acceptance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.