Loading

Get Al Att-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ATT-1 online

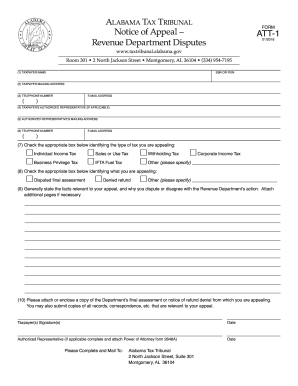

The AL ATT-1 is a crucial form for individuals or entities appealing decisions made by the Alabama Revenue Department. This guide provides clear, step-by-step instructions to assist users in completing this form accurately and efficiently.

Follow the steps to fill out the AL ATT-1 accurately

- Click the ‘Get Form’ button to access the AL ATT-1 form and open it in the online editor.

- In the first section, enter your name as the taxpayer in the designated field, ensuring accuracy for identification.

- Fill in your mailing address in the appropriate section to ensure that all correspondence reaches you without delay.

- Include your phone number and email address to facilitate communication regarding your appeal.

- Indicate the type of tax you are appealing by checking the appropriate box. Options include individual income tax, business privilege tax, and others as listed.

- Specify what you are appealing by checking the relevant box, such as disputed final assessment or denied refund.

- In the section for facts relevant to your appeal, provide a clear and concise explanation of your dispute with the Department's action. You may attach additional pages as necessary.

- Attach or enclose a copy of the relevant final assessment or notice of refund denial that you are appealing. Include any supporting documents that strengthen your case.

- Sign and date the form as the taxpayer. If an authorized representative is completing this, ensure they also sign and attach the necessary power of attorney form.

- Once the form is complete, save your changes, and prepare to submit it via mail to the Alabama Tax Tribunal at the provided address.

Take the next step in your appeal process by completing the AL ATT-1 form online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The AT&T low-income program is designed to assist eligible customers in accessing affordable communication services. This initiative offers discounted plans and benefits for those who meet specific income guidelines. By enrolling in this program, you can enjoy valuable features without straining your budget. Be sure to explore the AL ATT-1 program for more savings opportunities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.