Get Co St-16a (qe) 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CO ST-16A (QE) online

How to fill out and sign CO ST-16A (QE) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period commenced unexpectedly or you simply overlooked it, it may likely lead to complications for you.

CO ST-16A (QE) is not the simplest task, but in any case, you have no need for concern.

With this all-inclusive digital solution and its expert tools, filling out CO ST-16A (QE) becomes more efficient. Don't hesitate to try it and enjoy more time on leisure activities instead of handling documentation.

- Launch the document with our sophisticated PDF editor.

- Complete all the necessary information in CO ST-16A (QE), using the fillable fields.

- Insert images, marks, tick boxes, and text fields, if necessary.

- Recurring details will be populated automatically after the first input.

- If any confusion arises, utilize the Wizard Tool. You will receive helpful hints for more straightforward completion.

- Remember to add the date of submission.

- Create your distinctive signature once and place it in the required fields.

- Review the information you've entered. Rectify errors if necessary.

- Click Done to conclude editing and select the method you wish to send it. You can use virtual fax, USPS, or email.

- You have the option to download the record for later printing or upload it to cloud storage services like Google Drive, Dropbox, etc.

How to modify Get CO ST-16A (QE) 2012: personalize forms online

Your swiftly adjustable and modifiable Get CO ST-16A (QE) 2012 template is easily accessible. Utilize our collection featuring an integrated online editor.

Do you delay finishing Get CO ST-16A (QE) 2012 because you just don’t know where to start and how to proceed? We empathize with your concerns and offer an outstanding tool for you that is unrelated to overcoming your procrastination!

Our online directory of ready-to-use templates enables you to browse through and select from thousands of fillable forms designed for various use cases and situations. However, obtaining the file is merely the beginning. We equip you with all the necessary tools to complete, validate, and modify the document of your choice without leaving our site.

All you need to do is to open the document in the editor. Review the wording of Get CO ST-16A (QE) 2012 and verify whether it's what you’re seeking. Start altering the form using the annotation tools to give your document a more structured and tidy appearance.

In conclusion, alongside Get CO ST-16A (QE) 2012, you'll receive:

With our comprehensive solution, your finalized forms are generally legally binding and entirely encrypted. We ensure the protection of your most sensitive information.

Acquire everything necessary to produce a professional-looking Get CO ST-16A (QE) 2012. Make the right decision and explore our system now!

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, redact, and amend the existing text.

- If the document is intended for others as well, you can integrate fillable fields and distribute them for others to complete.

- Once you are done modifying the template, you can download the document in any available format or choose any sharing or delivery options.

- A robust set of editing and annotation tools.

- A built-in legally-binding eSignature capability.

- The ability to create forms from scratch or based on pre-uploaded templates.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for securing your documents.

- A wide array of delivery alternatives for smoother sharing and dispatching of documents.

- Adherence to eSignature laws governing the utilization of eSignature in online activities.

Get form

Related links form

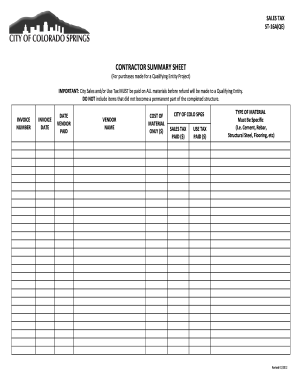

Filling out a sales tax exemption certificate requires you to state your reason for exemption clearly. Use the CO ST-16A (QE) as a guide to ensure you include all necessary details such as your business information and the nature of your exemption. Review the completed certificate carefully before sending it to the vendor.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.